Body corporate levies are set on a year to year basis, three months after the start of the new financial year. For reporting this creates issues.

Sometimes a disclosure statement or records search will quote levies for a period that has expired. For instance, say the levies are quoted to 31/7/2012 and yet the date of the report is 31/8/2012. Why aren’t the levies to the year end 31/7/2013 quoted? Is it a mistake?

It could be a mistake, but most likely, its an issue with when the next levies are issued.

Body Corporate End of Year Process

Levies are issued at the Annual General Meeting (AGM) and they are issued for one (1) year only.

But, following the end of financial year the body corporate has three (3) months to hold the AGM.

That period is to allow time to audit the previous financial year (if resolved to do so), prepare a budget for the next financial year and then convene the AGM in accordance with legislation.

So, if the financial year end is 31st July then the body corporate has until 30th November to convene their AGM and issue new levies.

Using Body Corporate Levies To Provide Cash Flow

From a body corporate’s perspective the flow of money is all important. To avoid situations where a deficit arises, body corporate levies for the next financial year are often pre-issued at the AGM.

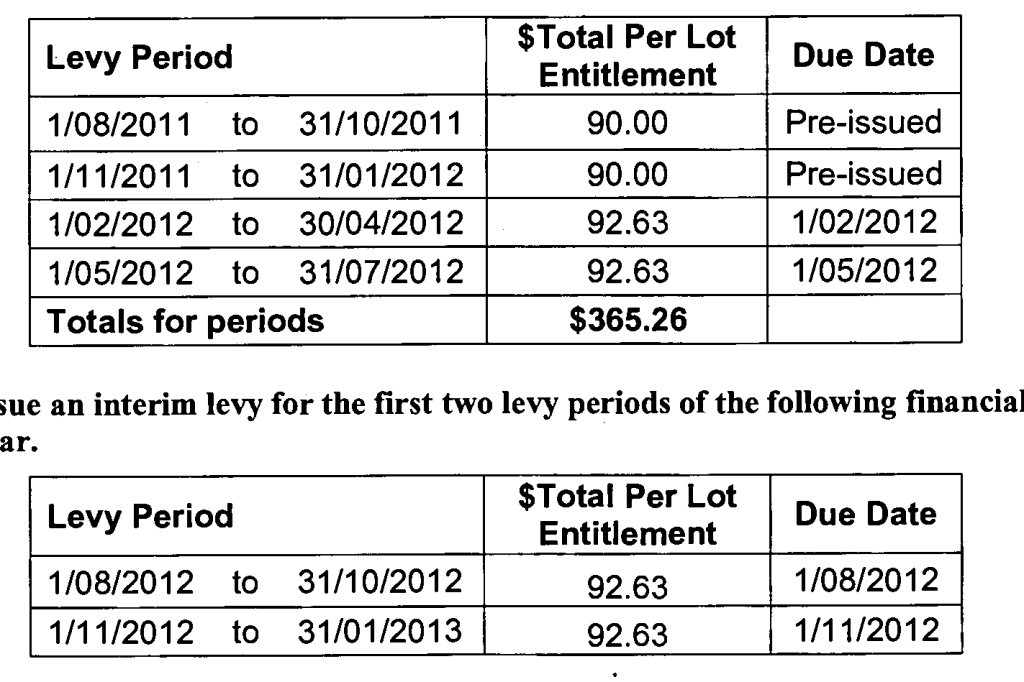

The example levy issue below shows the levies issue per lot entitlement for the four periods of the financial year ended 31/7/2012 – the first two periods having been pre-issued – and underneath that the first two periods of the next financial year.

At the next AGM the whole financial year will be issued along with the pre-issue for the next year.

Its important to note that there is no requirement in body corporate legislation to pre-issue levies for the next financial year and consequently not all body corporate manager’s have pre-issues approved at the AGM.

If the current financial year has expired on search documents this is most likely the reason. Refer to levy statements if included for how much the pre-issues are. Some documents will include the proposed levies for the next year if they have been calculated.

What If The AGM Is Late?

Sometimes the AGM doesn’t get held on time and there are lots of reasons that can happen from weather issues to scheduling delays to just plain incompetence on someone’s part be it a supplier, committee or body corporate manager. Sometimes it’s very difficult to co-ordinate so many variables.

There are specific guidelines for body corporates when that situation arises, some that get followed and some that don’t.

From a reporting perspective however, there isn’t anything that can be done about it. Each individual body corporates matters will play out as they play out and until matters are resolved there may not be anything to report.

Unless stated otherwise all the information on this website relates to Queensland legislation.

Unless stated otherwise all the information on this website relates to Queensland legislation.

Hi

I’m trying to determine if, when you sell your property with a body corporate structure, whether the excess funds that are within the body corporates bank account are refunded back to the owner once the property is sold?

Hi Helen

I’m not sure what you mean by excess funds. It unlikely anything you’ve paid to the body corporate will be refunded.

Your conveyancer should do a pro rata settlement of levies paid at time of settlement. So for instance, if you had just paid the levy for period 1/1/2016 – 31/3/2016 and settled 1st February, then you should be refunded two months worth of levies at time of settlement. That refund comes from the buyer and is accounted in the settlement statement.