Whenever I prepare a strata report one of the few documents I always include is a copy of the Sinking Fund Forecast. I do that for a very specific reason; they’ve a valuable source of a lot of information about the strata scheme, the Sinking Fund and management.

Whenever I prepare a strata report one of the few documents I always include is a copy of the Sinking Fund Forecast. I do that for a very specific reason; they’ve a valuable source of a lot of information about the strata scheme, the Sinking Fund and management.

What Is A Sinking Fund Forecast?

A Sinking Fund Forecast is a document that estimates likely capital works around the strata scheme, within a specific time frame, and then calculates how much to collect from lot owners to fund those works.

Body corporates are all about sharing costs equally.

When you’re calculating the Administrative Fund that’s simple; estimate a budget for the year, collect that much. If anyone sells during the year the two lot owners pro rata the costs between themselves and just like that everyone’s paid their fair share.

Things are not that simple with sinking funds.

For a start sinking funds are savings accounts. Their sole purpose is to accumulate large sums of money to finance capital works over a long period of time. They’re a great mechanism to ensure that everyone who has ever owned in the body corporate contributes something toward the future refurbishment and renovation needs of the scheme.

But how much do you collect? Well that’s where a Sinking Fund Forecast comes in.

A forecast is usually prepared by a Quantity Surveyor (though there’s no legal requirement for that) who inspects the site. They’re looking for what works need doing and the condition of infrastructure so they can then estimate how long it’s likely to last and what will or won’t need replacing.

Then they do some complicated calculations to work out how much those works will cost in the future and put the whole lot into a comprehensive report breaking down the collection into specific time periods.

Quite literally the Sinking Fund Forecast tells a body corporate how much to collect and when to collect it.

Is a Sinking Fund Forecast, or a Sinking Fund itself, really necessary?

In Victoria it’s possible to have such a thing as a “zero sum” sinking fund.

That’s not a zero sum sinking fund levy, which happens quite often, but a conscious decision by a strata scheme not to collect any sinking funds at all.

It’s an interesting concept. Great for those who are lot owners when the building is new, not so great for those faced with capital works and no funds.

It is true that there are downsides to accumulating large sums of money and basically leaving them to gather dust until needed. This article on Flat-Chat.com.au makes some very valid points on just this subject.

But I question the validity of giving some lot owners a free pass when it comes to capital costs and leaving others to foot the bill.

It’s a moot point anyway because in Queensland you have no option.

Every strata scheme must establish a sinking fund and issue a yearly sinking fund levy, even if that levy is nil.

And every strata scheme, with the exception of those registered with a two-lot regulation module, must also have a Sinking Fund Forecast for the current year and the next nine (9) years.

Sinking Fund Forecasts in practice

If a body corporate obtaining a ten year Sinking Fund Forecast in one year, to remain compliant with legislation they would need to obtain another the next year. And the year after that and so on and so on.

To get around this Quantity Surveyors provide 15 year forecasts. In this way the document only needs to be updated every five years.

How to use a Sinking Fund Forecast

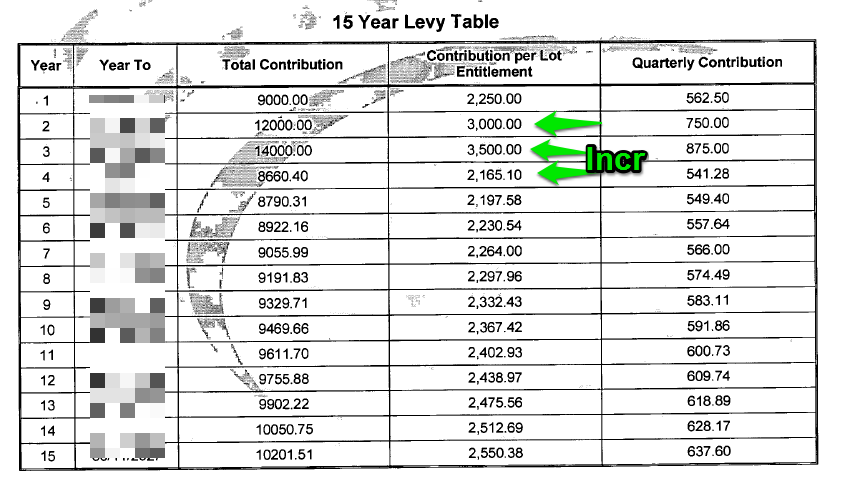

Figure 1: Sample levy calculations

Each Sinking Fund Forecast is going to have a table similar to the one shown in Figure 1.

The contribution per lot entitlement to collect for each year is clearly set out.

Every year the body corporate need only set the sinking fund levies in line with what the Sinking Fund Forecast suggests and things should work out reasonably well.

How useful is a Sinking Fund Forecast

Setting and collecting the sinking fund levy doesn’t happen in a bubble. If you set and collect that much it’ll all work out assuming nothing changes, and that’s a pretty big assumption. No Brisbane city body corporates planned to get flooded in 2011 but it happened all the same.

And any major expenditure not planned is going to immediately make the forecast obsolete.

The best use of a Sinking Fund Forecast is if the document is updated regularly to account for unplanned expenditure. That’s more expenditure though, which means higher levies, which means upset owners.

Sinking fund levies are only one half of the yearly levy puzzle and all Committee’s have the job of juggling their

Any tool is only as good as how you use it, and for some schemes the presence of Sinking Fund Forecast is treated as a legislative compliance issue, like displaying the Certificate of Classification.

Which is a shame because they pay for these documents and, if used correctly, they’re very helpful. It takes the guesswork out of setting sinking fund levies and ensures funds are available.

Sinking Fund Forecasts as a tool for buyers

In conjunction with a Strata Report a Sinking Fund Forecast is a powerful tool for buyers as there’s lots of little nuggets of information there.

For instance, in the table at figure 1, notice how the levies to be collected jump significantly in year two and three and then decrease in year four before steadily and slowly increasing (this is in line with CPI and to be expected).

This indicates the body corporate is planning capital expenditure for which they do not have enough funds. They need to increase the rate of collection to meet costs. If the scheme hasn’t increased the levies it’s reasonable to expect the works will be deferred or, if they’re urgent, a special levy will be issued.

An up to date Sinking Fund Forecast will also point out expenditure that may not have been discussed elsewhere in the records. Or alternatively it may not forecast expenditure that is being discussed, which has whole other implications.

Conclusion

Strata schemes in Queensland must have a sinking fund and a valid Sinking Fund Forecast for the next ten years. And if you have to have it in my opinion if you have to have it you may as well make use of it.

But then I don’t regularly set sinking fund levies so what do I know. I’d love to hear what any Strata Managers out there think on this subject. Leave a comment and let me know.

Unless stated otherwise all the information on this website relates to Queensland legislation.

Unless stated otherwise all the information on this website relates to Queensland legislation.

Can a Sinking Fund Forecast have costed items shown as provisional amounts. i.e. Costs that may be altered at a later date?

Hi Steve

Any costings you want can be included in the Sinking Fund Forecast. There’s no requirement to follow the recommendations made, and no requirement for it to include certain things. You could do it on the back of a napkin at the local pub. The only requirement is that it gets done.

Of course it is inadvisable to do your SFF on the back of a napkin at the local pub, and inadvisable to ignore the recommendations. I personally don’t like provisional amounts in a SFF – give me a nice clear amount payable in particular years. Some projects however require time to accumulate for so it’s helpful to allocate an amount each year until the total has been accumulated indicating works can be done.

Its all personal choice and what makes the most sense to committee, owners and whomever prepares the report.

Hi Steve

I doubt it though you’d need an opinion of a strata solicitor to be sure. The funds need to be held liquid so term deposits are OK. Anything more risky might not be possible.

can strata sinking fund be used to invest for strata body??