A deficit in the body corporate funds is a definite red flag as often it’s an indicator of a more serious issue financial issues.

A deficit in the body corporate funds is a definite red flag as often it’s an indicator of a more serious issue financial issues.

A body corporate is a legal entity, just a like a company or individual, and just like companies or individuals body corporates can run into financial problems, incur debt and be made bankrupt.

Unlike other legal entities a body corporate cannot have a sale or get a second job. In fact in this situation a body corporate only has one recourse to obtain funds and that is through levying the lot owners.

Which is what makes a deficit such a marker: it’s an indicator of a financial issue which will result in increased levies either through a significant increase in levy amounts or a special levy, sometimes both.

What does a deficit look like?

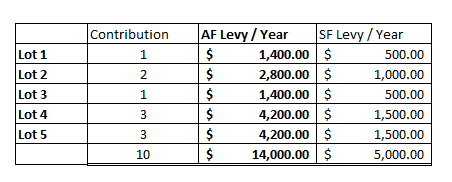

A healthy Balance Sheet is shown at figure 1.

Most, though not all, balance sheets show the last financial year end figures and the current year to date figures. Figure 1 shows positive, increasing balances from financial year end through the current period.

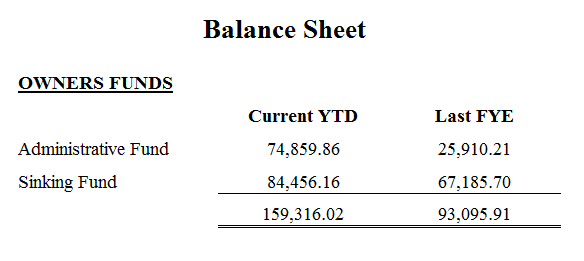

A deficit occurs when the funds held by the body corporate, as shown on the Balance Sheet, slip into negative figures.

Figure 2 below shows a Balance Sheet where the administrative fund has slipped into negative figures at the end of the financial year.

Simply put the body corporate has spent more money than they had available.

What makes deficits in body corporate funds dangerous

The vast majority of body corporates are managed by Body Corporate Managers.

And, most managers open one bank account for each body corporate which contains both Administrative and Sinking funds.

A deficit in one fund then is financed by the other fund. So an administrative fund deficit is financed by spending the sinking funds.

Which is not a problem, in and of itself, assuming the funds are replaced.

Why deficits in body corporate funds arise

There are a number of reasons why deficits arise including:

- Timing issues with collection of levies

- A major project is / has just finished and paid for

- There have been cost over runs on a project

- The budget has been miscalculated, often consistently

- Ongoing financial issues

Timing issues with levy collection

The most common reason for deficits, and what Figure 2 above is showing, is actually a timing issue with levy intervals.

Body corporate funds are collected at staggered intervals throughout the year whilst outgoings are incurred and paid continuous. It’s a bit like only getting paid every three or four months. Immediately prior to a levy issue the body corporate may look like it’s run out of funds, however the next levy issue resolves the matter.

This is something that happens mostly in the administrative fund and levies in arrears can also be a contributing factor here.

A major project is happening / has happened

Similar timing issues can happen in sinking funds when major projects are undertaken.

Funds are organised either through balances held, special levies or borrowing, however the expenditure will likely happen in large chunks at predetermined times, sometimes not in sync with fund collections, leading to deficits.

Cost overruns on projects

Body corporate projects are usually costed out very efficiently, however, any builder or contractor will tell you that unexpected things happen with projects. For example, if you’re halfway through a major renovation and find there’s concrete cancer, it behoves you to fix the issue whilst you’re there.

Cost overruns also happen when projects are poorly planned.

Overruns can affect both administrative or sinking fund, depending on the project underway.

The budget has been miscalculated

Sometimes deficits arise because the cost of running the body corporate has increased however, the budget, and consequently the levies, have not increased commensurately. The body corporate is spending more than they’re taking in and the deficit increases rather than being recovered.

Budget miscalculations tend to be ongoing since they often result from downward pressure on levies by the collective lot owners.

Ongoing financial issues

Occasionally a deficit can be an indicator of something more financially dire, like ongoing major capital needs due to building defects that have exhausted the body corporate’s collected funds or an under collected sinking fund over a number of years.

Deficits in body corporate funds mean levy increases

Any overspent funds need to be recouped immediately.

There are two ways of doing this – a special levy or an increase in the levy issue for the overdrawn funds, possibly both.

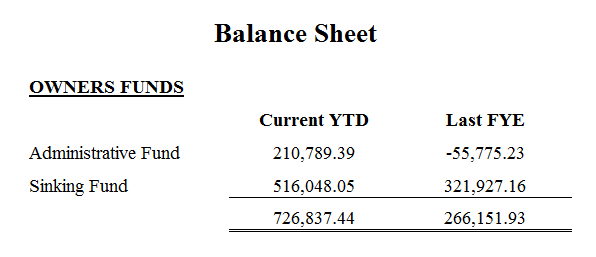

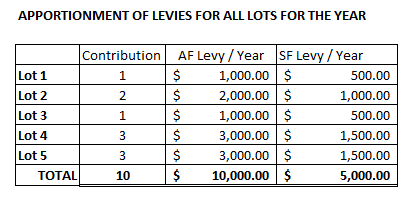

For instance, say the admin fund budget for the year is $10,000 and the sinking fund $5,000, collected as set out in figure 3.

If during the course of the year the body corporate spent an extra $2,000 in administrative funds then a deficit would result. To recoup that deficit the body corporate could:

- Issue a special levy to collect the $2,000; or

- Increase the budget in the next financial year to $12,000

But, if the extra $2,000 spent reflects actual ongoing costs of the body corporate then the body corporate could:

- Issue a special levy to collect the $2,000 and increase the budget for the next year to $12,000;

- Or, increase the budget for the next year to $14,000.

Both achieve the same thing and the new levies look more like figure 4, including a substantial increase.

Figure 4: Yearly levies collected with increased administrative fund

If there is a deficit

Any time I see a deficit in body corporate funds its a warning bell to me to look for something deeper going on.

At best it’s a timing issue and has already been resolved.

However, worse case scenario, the building has been underfunded for years and now has severe building defects and minimal funds to deal with the issue. The costs could run into the $100,000’s.

What is most likely is the deficit will be addressed eventually, through some sort of increase. How frustrating to be a new owner having to pay an increase to cover previous owners who paid too little.

If your body corporate record search highlights a deficit in body corporate funds ensure you get a handle on what’s causing the deficit so you can make an informed decision about what may be happening. In some cases it’s not an issue and it may even put you in a good bargaining position. The point here is to be aware.

Update 31/10/2013:

I saw a great article today where Chris Gray of Purchase or Pass? discusses just this point. See below for details.

I would note that the discussion of increased levy issues bringing the funds back into line are true but don’t seem to take into account that those funds are actually spoken for. Unless the budget includes the recovery of part or all of the deficit, then it’s likely that over the term of the levy issue the fund will end up in arrears again.

Certain things stand out as red flags in body corporate records. A red flag is not necessarily a reason not to buy a property or even an indictment of that body corporate or it’s management, more a highlight of something that could be an issue and needs more investigation and consideration. If a “red flag” is highlighted in your body corporate records search please consult with your solicitor.

Unless stated otherwise all the information on this website relates to Queensland legislation.

Unless stated otherwise all the information on this website relates to Queensland legislation.

What happens, when there are chronic 90 and 120 days overdue levies NOT collected, the funds are getting negative and issuing special levies to top up are not an option any more.

can the strata title company go “bankrupt” and what will actually happen? In my case there are 70 blocks of land plus a common tree farm at stake.

Thank you.

Hi Lothar

Yes, a body corporate is a legal entity and, as such, potentially can go bankrupt. It doesn’t happen because owners that do pay are continually tapped to pay special levies.

What will actually happen is that services will no longer get paid so they will be stopped. You’d have to review the body corporate budget to see where costs could be trimmed or eliminated altogether.

This is a challenging situation. The solution is to force the overdue owner(s) to pay or sell.

Hi Lisa,

We are facing a similar situation with 6 of 14 lots in arrears, already bankrupt or just not paying. We’ve gone to court (we win) and attempt bailiff auctions, but the units aren’t selling due to the circumstances (high levies mostly as those that do pay are propping everything up) so we never recoup the costs outstanding plus the additional legal fees.

Special levies are no longer sustainable and we are faced with the very real possibility of the body corporate going bankrupt and being unable to pay even the building insurance.

What would the outcome of this be? Would we all be forced to sell?

I’m struggling to find information on this kind of situation.

Thanks

Hi Shanon

In all my years searching I’ve never seen a body corporate that has gone bankrupt. The owners who do pay prop the whole thing up until a break occurs, usually a lot owner selling and paying up owing amounts. Bankruptcy is not a good option for a body corporate, because it is intricately entwined with the lots. You cannot bankrupt common property but not the lot owners because it is impossible to separate the two. The responsibility for the debt burden on owners would continue even if the body corporate is broke.

Not renewing the building insurance would precipitate some fairly serious consequences. Presumably all the lots are mortgaged. All mortgages have a term requiring the lot be insured. BC legislation requires the body corporate to insure the properties including common property unless they’re free standing homes. If the lots are not insured then each of the mortgages is in default and the mortgagee may take possession.

That’s never going to be a good scenario, not least because banks will not want any part of it. The values of the property would plummet in such a dire situation and they’d no longer be able to recoup their investment. It is common for mortgagees to do nothing when the debts associated with a property are higher than the value of said property, which would just compound the situation for the owners.

You need to work through this by forcing the delinquent owners to sell. If you haven’t already get legal advice, from someone experienced in both debt collection and strata. You might need to force the sale of a unit or two. I’ve not sure how you go about it but you can seek orders to bankrupt an owner which will then force their mortgagee to make their first claim on the capital, the lot. In that situation outstanding contributions and costs might not be recovered, at least in full, but it will bring another ‘paying’ owner into the fold and relieve some of the pressure.

The ideal situation is that the Mortgagee or local Council take legal action rather than the body corporate.

Bankruptcy is an option but given that the lots are part of the body corporate its not a good one.

Thanks for the speedy reply Lisa. This is both what we suspected and feared.

One of the units has already been made bankrupt but we were unable to recover any costs.

Another is going to bailiff auction for a 2nd time in the hopes it will sell.

Fingers crossed it does and keeps us afloat a bit longer to sort out the rest 🙂

We have a strata management company who is managing these matters but not sure they are fully competent at this stage.

Either way – thanks again!