How much is in the body corporate sinking fund? This is the most common question when buying a unit.

How much is in the body corporate sinking fund? This is the most common question when buying a unit.

Unfortunately the balance is only half the story. The more telling part is how much should be in the body corporate sinking fund?

This article is about how a body corporate sinking fund is accumulated, where the process goes pear-shaped and the implications for both owners and buyers.

The purpose of a Sinking Fund

The purpose of a body corporate sinking fund is to collect a small amount toward long term upkeep from everyone who has ever owned a lot.

The goal is to have funds available for major upkeep works, like painting or lift refurbishment, as and when they’re required. If funds are available it increases the chances the works will get done which extends the life of the building.

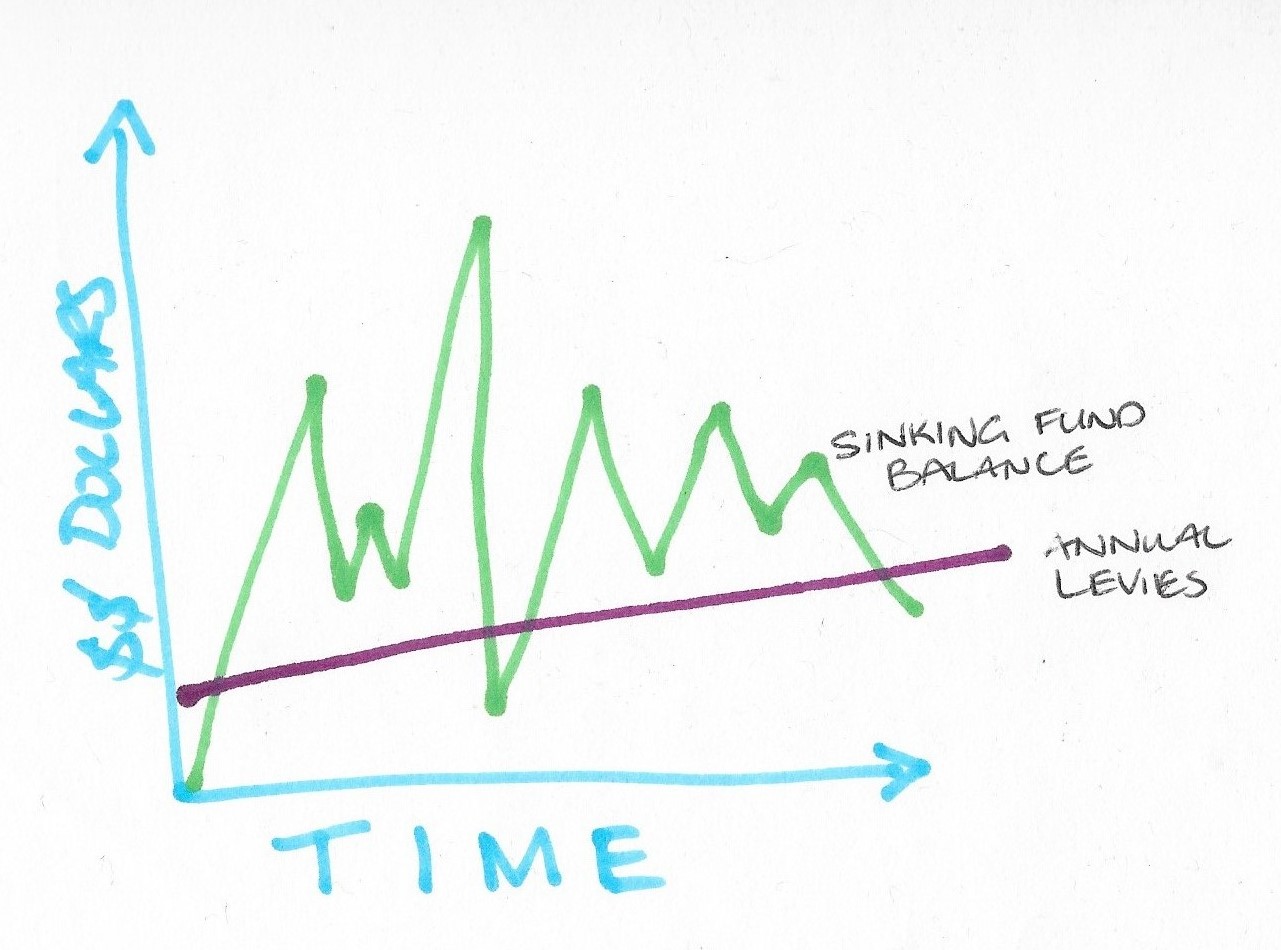

The concept is to have a set, gently upward trending levy, year in year out, so owners can budget with confidence and the body corporate can fund works as they’re required. The major fluctuations happen within the sinking fund balance.

Annual Sinking Fund Levies trend gently upwards over time giving certainty to owners and available funds to the body corporate when required

Where Do Special Levies Fit In?

The day to day costs of running the scheme are funded from the Administrative Fund and capital works from the Sinking Fund.

All expenditure is expected to be carefully planned and budgeted: the administration cost from year to year and capital cost over a continuous ten year time horizon.

With the best of intentions it’s impossible to forecast for every situation that might arise. Anything that isn’t included in the annual forecasts is considered “unbudgeted works”.

Unbudgeted works should be financed by raising a special levy.

It’s quite simple and clear cut: If you didn’t plan it, don’t do it. If you go ahead and do it anyway then raise additional funds to pay for it.

Where Sinking Fund Accumulation Goes Pear Shaped

There are two main ways that body corporate sinking fund accumulation gets distorted:

- Accumulated funds are spent on unbudgeted works;

- Sinking funds are incorrectly collected.

Accumulated funds are spent on unbudgeted works

When an unbudgeted situation arises the body corporate will often rectify the problem and fund the works from existing sinking funds.

There are many valid reasons why the works might be funded this way, despite the fact it’s contrary to legislation.

Speed is a key factor. It takes time to raise a special levy and sometimes works might be urgent.

Relative cost is another issue. It can be cheaper to just do it and pay with available funds than to hold an EGM and issue a special levy. Strata meetings can be pricey.

In most cases the works, though unbudgeted, can easily be absorbed by the scheme with no ill effects to speak of.

In practice all of that is fine. Right up until it becomes a problem.

For instance, say the scheme spent 10% of the fund five years ago to pay for unbudgeted works and made no effort to recoup. Now the scheme finds itself with 15% less than is required to undertake scheduled works. That’s the power of accumulation. Deficits accumulate too.

If unbudgeted funds are taken from the sinking fund some sort of allowance must be made. That can be done by replacing the funds, delaying works or reducing the cost of works.

Sinking Funds Are Not Collected Correctly

The key purpose of a Sinking Fund Forecast (SFF) is to give the body corporate clues as to what sinking fund levies to collect. Even with a forecast sinking fund levies are a ‘best guess’.

Bodies corporate are required to have a forecast but they’re not required to follow it. When sinking funds are incorrectly collected essentially strata schemes ignore their SFF and collect levies based on what they believe the owners will be willing to pay.

Consequently it is common to see a forecast estimating a levy of $500 per lot entitlement with only $400 collected.

Its pretty simple; If you don’t accumulate the projected levies then the projected balance won’t be obtained and funds won’t be available when works are required.

Supercharge Problems by Combining Causes

In practice it is relatively uncommon to see buildings under collect their sinking funds for long periods of time. It’s something that happens most often in smaller buildings where owner apathy or poor management is an issue.

What happens most commonly is that unbugeted works are paid repeatedly from the sinking fund yet the SFF projections for accumulation are still being followed. It’s effectively still under collection since no effort has been made to recoup previously spent funds.

Under collection and unbudgeted works together will lead to negative sinking funds quite quickly, especially when combined with apathy.

Body Corporate Sinking Fund Levy Corrections

A levy correction is a sharp change in annual sinking fund levies other than for CPI.

Corrections can be upwards or downwards.

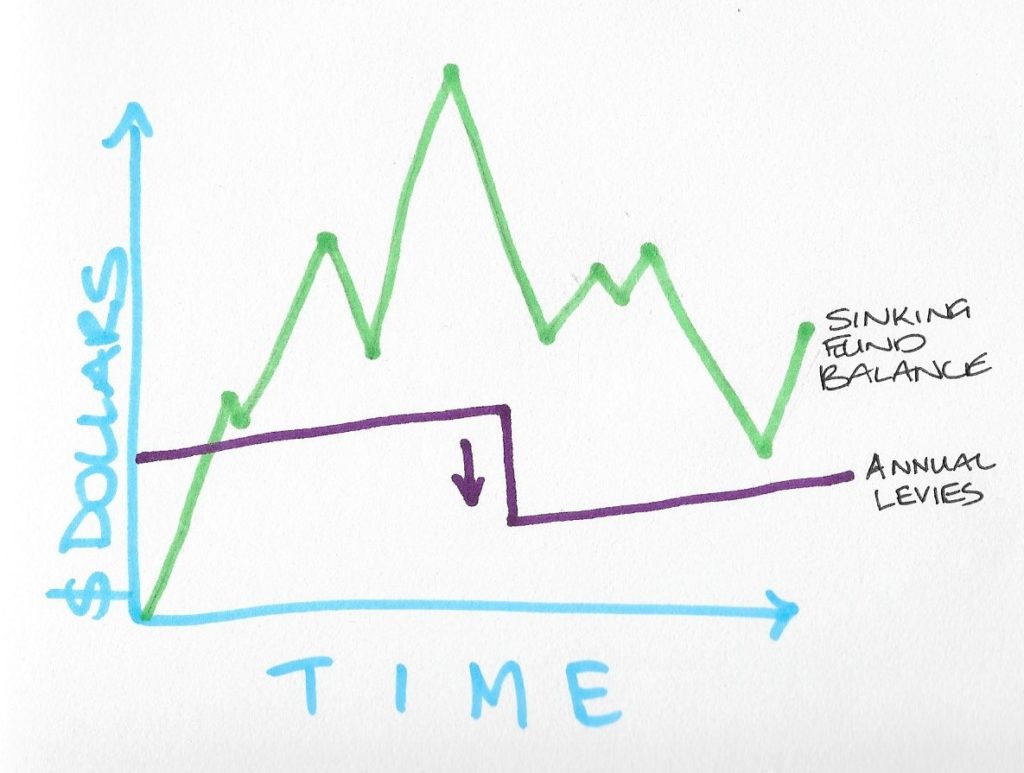

Downwards Levy Correction

Sometimes annual body corporate levies are set too high and the strata scheme collects more than they need. Annual sinking fund levies then need to be corrected downwards

Some bodies corporate collect sinking fund levies that are too high. They achieve their capital accumulation goals too quickly and find themselves with extra funds.

Annual sinking fund levies need to be corrected downwards. So as an example, if the levy was $2,000 per annum it is lowered to $1,000 per annum moving forward and will trend upwards again from there.

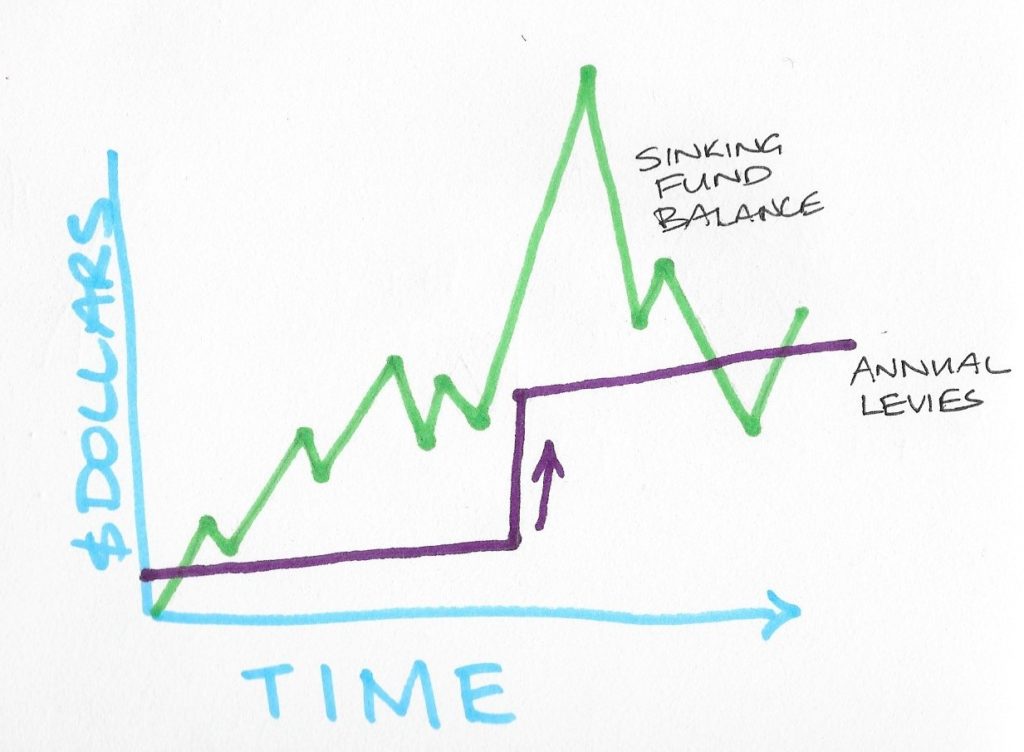

Upwards Levy Correction

Setting the annual sinking fund levies too low will lead to a correction upwards; a large, permanent increase in sinking fund contributions required

It is far more common for bodies corporate to not collect enough sinking fund levies over the timeframes required.

The result is a major deficit in funds required and will eventually require a correction upwards.

An example would be annual levies of $1,000 per lot entitlement doubling to $2,000 per lot entitlement per annum.

Upward corrections often go hand in hand with special levies. Owners often object quite strenuously to large increases in levies so necessary decisions are put off, sometimes until the need for funds becomes critical. The scheme finds itself needing cash immediately (special levy) plus an ongoing increase (levy correction).

Why levy corrections Are An Issue

It’s pretty hard to see how a levy correction downwards would be a problem for anyone. Indeed, if you’re a buyer and your chosen scheme has had a recent downward levy correction it’s a cause for celebration.

Of course if you’re the seller its’ not such good news. What’s happened is you’ve paid more than your fair share of future capital works. When you sell you walk away from that. Not such a nice place to be.

By contrast it’s easy to see why levy corrections upwards are not a good thing.

For a start it’s going to put off buyers. Nothing say’s don’t buy me like a sinking fund in dire need of cash injection.

More importantly increasing the levy, or indeed issuing a special levy, is only the first step. The next step is to collect the funds and with large amounts that’s not always easy.

Large increases in levies lead to levies in arrears and additional costs to the scheme for collection. Additional costs means additional levies and further delays, which, you guessed it, leads to additional costs.

It can get to a point where everything becomes critical: the delays and the issues they cause become urgent and cash is needed right now! Owners end up feeling like they’re bleeding money and there is no choice but to continue through the process because the chance of attracting a buyer is slim.

Upward correction of sinking fund levies is a ‘red flag’ as it often goes hand in hand with a number of other issues like ongoing poor maintenance, building defects or dilapidation and poor financial management.

Conclusion

The body corporate sinking fund balance is part of your lot’s value. A sinking fund balance that is too low is a detriment for buyers. With good reason. It is an indicator of a risk that owners may be asked to contribute additional funds over and above the current levies.

NOTE: The question I haven’t answered here is “how do I tell if the sinking fund balance is too low?”

I did start writing the answer and it got … technical.

If you’re comfortable with and can access body corporate documents look out for another article in the next couple of weeks which will show you how to analyse your scheme sinking fund.

Unless stated otherwise all the information on this website relates to Queensland legislation.

Unless stated otherwise all the information on this website relates to Queensland legislation.

Fantastic article thank you and very timely. I am the newly elected treasurer of an owner managed body corporate for a small scheme and we have insufficient funds in both sinking and admin accounts and have done for years. The situation is critical, such that a special levy is required but has not been actioned on as yet, much to my dismay. The other unit owners do not want an increase in levies of any form and I am finding it most frustrating and frankly alarming. I think every owner should read this and understand the importance of paying the correct amount of levies, not what they would like to contribute. Thank you

Hi Di

Its quite possible I wrote this article especially for you. I often see schemes in the same positions as you’ve described and it’s frustrating for those of you who understand what’s happening to try and convince everyone else. I wanted to give you some ammunition to help!

The problem with doing nothing is that eventually there will be a tipping point. Unfortunately some schemes leave it until then. In my opinion its better to take action when you can do it in smaller doses.

Good luck with swinging the vote.

Thanks Lisa I couldn’t agree with you more about doing nothing. The tipping point arrived a long time ago, however I am a lone voice and see no way that I can swing the vote in a positive way. I guess the crisis will have to occur (when a massive injection of funds will be required) before I am taken seriously. With me luck! Cheers Di 🙂

I liked your article but I have a question regarding the Sinking Fund and its use.

We are Standard format Plan and have collected for Painting and Insurance (while technically we Should not) it has allowed us to keep the complex uniform and excellent condition. We have on owner who feels we should not be able to do this and the commission has apparently said that we have been acting illegally. He has said the managers work on the owners lots (mowing and gardening; as per his agreement) has to be reviewed and stripped from his agreement. I thought the Merrimac Heights (http://www.wolterskluwercentral.com.au/legal/uncategorized-legal/the-merrimac-decision-lot-owners-take-note/ then Costs http://www.austlii.edu.au/au/cases/qld/QSC/2012/79.html) would make this agreement valid.

I believe the adjudicator has said that we can longer obtain insurance for lot owners (saves them money [$320/yr vs $800+/yr] and better excesses;$250/claim vs $600/claim) yet we have to pay insurance for the duplexes (can we recover this as a BC? Maybe a levy for the Duplexes Seems very unfair if we can’t). We also have to paint the common walls and gutters for the Duplexes again unfair.

Also he has said we cannot organise the painting through the BC.

It very complex and as owners we have been asked to write a submission regarding the painting passed at a AGM.

Hi Dave

The foundation premise of body corporate legislation is that the body corporate is responsible for common property and the lot owner is responsible for the lot. Its the bedrock on which bodies corporate operate and everything else from there is about equitably sharing costs and assets.

From what you’ve discussed here it seems to me that the body corporate has extended its responsibility to include painting of the scheme, insurance and lawn mowing. The problem is that areas being maintained are part of individual lots and consequently the body corporate is infringing on the rights of the lot owners. Further there is an unnecessary burden on the owners to fund these costs which should be paid by the lot owners themselves.

Owners may certainly negotiate together and enter into contracts for insurance, painting and lawn mowing however it can not be made compulsory as the body corporate has no power to make decisions about what happens to a lot. Any agreements such as these negotiated by the body corporate require each owner to individually contract with the body corporate before proceeding.

I understand it has given owners a sense of uniformity having the grounds maintained by one contractor and control of the exterior maintenance. Its come as a result of infringing rights however and should be stopped.

With insurance, the body corporate is required to insure any lots where the buildings are joined. So the body corporate should insure the duplexes but not free standing houses. The cost of insuring the duplexes should be shared between the duplexes and all owners should contribute to the insurance of common property.

I know that’s not what you wanted to hear Dave and I’m sorry about that. In a lot of ways a Standard Format Plan is more complex than a Building Format Plan though ultimately the costs should be cheaper because the common property is significantly less.

Thanks for that I hear what you are saying and I agree that is what the legislation says but why should the other owners carry the cost of the insurance for the 14 Duplex owners of Roughly $4500 so an added cost of $38 for each lot owner of which the duplex owners benefit. Are the body corporate able to get reimbursed for the Insurance payment?

The other problem that is apparent is the manager is paid to do gardening on the owners lots as well as the common property. Note there is a difficulty here as the common property finishes in the middle of a garden. That is half of the garden belongs to the owner and half belong to the BC.

So the manager hedges the front half of the hedge and the owner does the back?

Because this caretaking contract is in place we will have some difficulty changing it. In the Merrimac Heights case the Supreme Court found for the manager against the BC when they tried to change this (stopped paying the manager). Any thoughts I know it won’t be a legal opinion this could get expensive.

Hi Dave

I think we’re talking about the same thing with insurance. The duplex owners should pay their own costs. The other owners, if they’re insuring separately, should pay their own costs. Common property insurance should be split amongst owners via interest lot entitlements.

The body corporate should raise an annual insurance levy, payable by the duplexes owners only, based on their interest lot entitlements, to recover the cost of their insurance.

Re the garden maintenance: The Merrimac Case notes the body corporate had the power under s 158 of the BCCM Act and 167 of the Body Corporate and Community Management (Accommodation Module) Regulation 2008 (Accommodation Module) to enter into the lawn maintenance agreement.

In the case of your scheme I would argue that the agreements weren’t validly entered into because the body corporate had no right to make arrangements around lot owner property.

Dave, you’re quite right this is a legal matter and could get quite expensive. The agreements should be altered to remove the lot owner property maintenance however it will take some negotiation with the contractor because they will lose out through no fault of their own. Not a pretty situation at all.

Also the managing of common property and owners lot boundary is in the middle of the garden bed. As an owner I want the hedge at metres and the manager does the front at 1.2 metres. How do the BC cope with this?

Hi Dave

Negotiation is what’s going to solve this one as well. Putting the hedge right on the boundary of lots and common property might have seemed a good idea at the time but it really would be much better if it was contained wholly within one or the other. So it’s either lot owner responsibility or body corporate.

That said, you can only deal with what you have, in which case I would suggest that the rules regarding fencing are applicable, since the hedge is acting as a fence ie 50 / 50 cost share.

Hi Lisa

I emailed a few weeks back re manager of large complex going on leave for extended period ie 1 yr plus.

I obtained documents from OFT and discussed with the mgr the necessity for particular licences etc for the relieving manager which is all fine.

However our managers lawyer advised him that it is nothing to do with the body corporate committee and that the committee should not be involved at all even including interviewing the relief manager

I must stress that there is no dispute with our manager and the committee supports his extended leave however the committee does feel an obligation to at least hold discussions with the relief manager to among other things ensure his qualifications and experience are suitable .

Can you provide your opinion or view here please Lisa.

Many thanks and appreciate your interesting site.

Hi Ronald

I can see where the lawyer is coming from here. The replacement is a Caretaker issue. The terms of the agreement are not being altered in any way and the Caretaker is still going to be responsible for fulfilling the terms of the agreement. The relief is simply an employee of the Caretaking contractor.

From the body corporate’s perspective, it’s not their business. Of course it would be ideal for the Caretaker to put the committee’s mind at rest, at least with regards licencing, but again, not compulsory. If there are issues with the relief it’s still the Caretaker who will be breached.

Hey Dave, I got rid of our thieving Caretaker. He had been there for 15 years with three to go.He lived in Bali, collected $32,000 a year and had his offsider coming to the complex most days.

The poor bloke was quite mad, he was collecting about $200 a week mostly through unlawful regular payments from the BC Company, not covered by any minutes of meetings at all.

I got rid of both of them through reading 15 years of meeting minutes. And finding dodgy repairs to the building totalling about $25,000. He argued for months and cost us $6500 for lawyers but we won

We had a massive sinking fund and a buggered building. The Sinking Fund Report was a joke, we totally ignored it and got a current engineers report for $4500. Now we have spent about $180,000 on 42 units and it looks fantastic.

I have just gone through my Group Title complexes paperwork as I am being voted in as chairperson. Apathy and mismanagement is rife. Previous committees have spent money, on painting, lights on owners lots properties, whirly Birds, and whirly bird maintenance with no reimbursement to the sinking fund. Leaving the sinking fund with $20,000 for 15 units. Now a major safety issue has arised , which will exhaust the sinking fund with most likely a debit to incur. The front boundary masonary fence which divides the complex from a main road is leaning dangerously onto council property and the BCC bus stop is the only thing holding it up and will cost $30,000 to repair. Due to the fact the previous committees have found this problem too hard to handle it has been put on the back burner instead of being addressed when it could have been fixed. I just don’t know as a new resident what action needs to be taken.

Hi Lynne

In the short term I would see if there are temporary repairs that can be made to make the fence safe. I’d ask the person who gave you the quote of $30K. In the long term it sounds like you’re going to have to make good the repairs. Getting a second quote is the place to start there.

If the funds are not available then you’re going to have to raise additional funds. There are a couple of ways to do that. The first is of course a special levy. To raise the whole amount is $2,000 each, assuming an entitlement of 1 per lot. You have some funds so you may not need to raise the whole lot. It might be the best way to proceed though, so that then you don’t empty out your sinking fund.

The second option is to apply for a strata loan. I’ve never done that so I don’t know how much can be borrowed but its certainly worth considering. You’d then need to increase levies to fund repayments of the loan.

Having a discussion with the whole committee, including the body corporate manager, is a good place to start.

Hi Lisa,

I am close tp buying a townhouse ( 6 in complex) not gated but freestanding. Only 6k in sinking fund, used nearly 30k on painting and tidying entire place early this year.

Low maintenance complex with no pools, gyms etc.

Should i be concerned?

Thank you.

Hi Lewis

The money has been spent painting and tidying up, which is great. That’s exactly what the sinking fund is meant for. It immediately adds value to the property and extends its viable life time.

Whether or not its a cause for concern will depend on other factors. The Sinking Fund Forecast is the place to start. Had the scheme collected in accordance with the fund? Were they raising levies as suggested? This will give you a baseline. If they were supposed to have $100K in their sinking fund before painting but only had $50K, then yes, its concerning.

That’s because the other part of the equation is whether there are still works pending. A low sinking fund balance after major works is not a problem, its planned expenditure. The problem arises if the works that cleared out the sinking fund were only the first in a long list. Find out what else, if anything, is pending.

There’s a good chance this is simply execution of planned maintenance, in which case gold stars all round.

I don’t like the phrase “tidying up” though. It suggests that things have been let go for a while, but hey, I’m professionally cautious. Ask around and see what you can find out.

Thank you so much Lisa. I presume my solicitor/conveyancer will be the best person to analyse and perhaps request the forecast on my behalf?

I absolutely love the place so hoping it all goes well.

Thank you

Hi Lewis

The best person to request and analyse the SFF is a search agent like me. Though it should also be considered in context of a review of the minutes and documents of the scheme. A pre purchase strata report is always a good idea.

Your solicitor may know enough about strata schemes to offer analysis. Ask them and find out.

I’m interested in buying a place. I’m a first time home buyer. It says the following but not sure what it means: last rates received $408, sinking fund balance $23,300, body corporate Levis pre approved $ 855, sinking fund pre-approved $373. The place cost $460,000.

Hi Iba

The figures you’ve quoted don’t really mean a lot without some context. What are you wanting to know about the body corporate?

Hi Lisa,

Balance of Sinking fund at end

of last Financial Year as at 31/08/21

(992,742.12)

Yes, almost $1 million in the red….

I understand some major refurbishment was done last year, there was lots of under budgeting, and the final bill was $600K more than planned. The BC took the builder to court, and lost, and ended up with an $800K debt instead of $600K. $800K loan with a bank, with the plan to repay the debt in 10 years.

50 units, sinking fund contributions currently at an average of about $5k per unit per year, so $250K of contributions to service the debt and eventually the SF contributions should fall when the debt is repaid.

Looking at purchasing a unit in the building. Am I mad? Assuming they do return to a positive balance in 10 years (ish), what sort of discount on the purchase price should I be looking for on a $1 million dollar unit? The secretary of the BC is a friend I would trust with my life, so I am not too worried about future mismanagement, but can they recover from this, or is it a slippery slope?

Hi David

Yes this body corporate can and will recover … there is little other option. The key question is what else is going to come up in that 10 year period. Exterior painting is the most common and expensive maintenance item most schemes deal with and it needs to be done every 8 – 12 years, depending on location. The more toxic the environment, such as close to the ocean or middle of the city, the more crucial it is to make sure works are done promptly.

Whilst the loan is being paid off how much is being put aside for future works? What is most likely to happen is the loan will be paid quicker than the ten year period but the sinking fund contribution may not come down too much as now you need to catch up with capital works, and 10 years older, the building may be starting to need refurbishment ie upgrades to common areas.

And if something comes up within that 10 year period, then there’s likely going to be a need for capital funds by way of special levy, or another loan.

Its a risky situation. The chances of increases to contributions or special levies are significantly higher than normal.

To know how much discount to ask for, ask yourself, what would make you feel better about taking on the risk? Quantifying an amount is difficult without knowing what the works were. If it was painting and exterior repairs or lift or other upgrades you will be paying for the cost, but also reaping the benefits into the future. If it was defect rectification you will be paying for the cost but the seller reaped the benefit by lower levies whilst they were owners.

I’d also suggest that if you do proceed with a discount, act as if you haven’t and put the money aside in an offset account in case there are special levies or increases.