Who pays for what when ownership is shared?

Who pays for what when ownership is shared?

For all their complexity body corporates are simply mechanisms for managing common property.

That common property is owned by the collective lot owners who are responsible for paying for the upkeep of said property by way of levies.

How to actually calculate who pays and owns what is defined in Queensland by the schedule of lot entitlements. They set out both who pays for what (contribution lot entitlements) and the proportion of ownership of the scheme (interest lot entitlements).

Schedule of Lot Entitlements

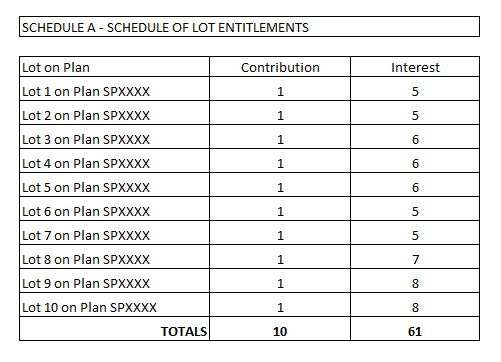

The schedule of lot entitlements is set out in Schedule A of the Community Management Statement and is the basis for calculating who pays what within a body corporate.

Its also the basis for a great deal of arguments, legal and otherwise but that’s a whole other story.

TWO TYPES OF ENTITLEMENTS

In a Community Title Scheme there are two types of lot entitlements – contribution schedule lot entitlements and interest schedule lot entitlements.

CONTRIBUTION schedule lot entitlements denote the amount of contribution toward the upkeep of the body corporate that each lot will be required to pay. Using figure 1 above each lot would pay 1/10th of the yearly budget for administrative and sinking levies.

The contribution lot entitlements in the example above are equal, and in fact legislation requires contribution lot entitlements be equal except to the degree that it would be inequitable for them to be equal.

What that means in practice is that those lots that cost the body corporate more, for whatever reason, should be required to contribute more towards that upkeep. So for instance bigger lots would be able to have more people therefore more use of common property, and should therefore pay more levies.

How that’s actually calculated is the subject of much deliberation by the courts and adjudicators.

INTEREST schedule lot entitlements set out the interest of each lot in the overall value of the scheme. Interest entitlements allow developers to set the value of the different units based on the what they actually added to the unit.

So for instance if the lot has granite bench tops and top end fittings and is higher in the building than a similar apartment then a higher interest lot entitlement is given. By keeping contributions entitlements even running costs are distributed fairly, whilst interest entitlements allows value to be distributed fairly as well.

If for some reason a body corporate is extinguished, say there’s a catastrophic fire and the building is to be demolished, then the dollar amount that each lot owner will be paid is calculated using the interest schedule lot entitlements.

Referring to figure 1 again, if I owned lot 7 my proportion of the value of the body corporate is 5/61.

If contribution and interest lot entitlements are different, as in figure 1, then the body corporate should issue an insurance levy calculated on the interest schedule lot entitlements.

Using the same example, if a building is insured for $1,000,000 and lot owner would get 5/61 of the value were a claim made it corresponds that the lot owner should also pay 5/61 of the premium.

Contribution and interest lot entitlements are also used to calculate rate costs and sometimes water costs.

photo credit: <a href=”http://www.flickr.com/photos/sepehrehsani/5766453552/”>Sepehr Ehsani</a> via <a href=”http://photopin.com”>photopin</a> <a href=”http://creativecommons.org/licenses/by-nc-nd/2.0/”>cc</a>

Unless stated otherwise all the information on this website relates to Queensland legislation.

Unless stated otherwise all the information on this website relates to Queensland legislation.

I am in a corporate body where we own the land and home and as part of our weekly management levy we pay our share of road maintenance, insurance, body corporate management, gardening, security etc

This corporate body is a member of a larger corporate body [about 5 in all] there is a joint committee for overall management. Overall costs between each of the corporate bodies are allocated on an easement basis. I assume that easement means a physical entity or quantity. There is a dispute in our set up where one of the body corporates thinks its members are not getting value from the levy charged. I think the basic cost allocation is made on the number of houses in each. Can you please comment on the easement scenario

Hi Jim

That sounds like an unusual setup. Usually if you’re part of a layered scheme then the Principal Body Corporate (PBC) would have its own CMS which sets out the contribution and interest lot entitlements of all the subsidiaries. The budgets and levies payable are calculated by the PBC just as they are for every body corporate. An EGM is held each year, etc, etc. The PBC is just another body corporate but instead of “lots” it has “subsidiary body corporates”.

If you are paying costs based on easements it depends on how those costs are calculated and what they’re for. If its to maintain something the other scheme does not have access to I can understanding why they might be upset.