A body corporate is a mechanism for managing common property. A mechanism funded by lot owners.

A body corporate is a mechanism for managing common property. A mechanism funded by lot owners.

Body corporates can and do run into difficulties stemming from many different issues. And if they get into difficulty they’re most likely going to finance any extra funds needed by way of levies on the lot owners.

If its important to you to be able to budget clearly in the first year or so of buying check the financial viability of the body corporate before you finalise the contract.

To judge fiscal strength of a body corporate you need to check the following four key performance indicators in the body corporate financial statements.

Body Corporate Financial Statements

Just a quick note before we get into it; getting hold of body corporate financial statements can be a problem, even doing a search. Legislation requires financial statements be prepared once per annum after end of financial year. Some managers can provide current statements at any time, however some don’t and there’s nothing that can be done about that. So … conceivably you could be looking at financial statements up to 12 months old.

Body corporate financial statements are a bit different that regular business financial statements. There is still a Balance Sheet and an Income and Expenditure Statement but they look somewhat different and they tell different stories. For a start a body corporate does not trade so the idea of “profit” is nonsensical.

Along with different statements there are also different measures. The key measures in body corporates are about fund balances, cash flow and budget forecasts.

1. Deficits in Body Corporate Funds

The Problem

A deficit in owners funds is a “red flag” in body corporate records. It’s an indication of anything from a simple timing issue to ongoing severe financial or defect issues and usually results in increased levies in the immediate future.

Further reading: Deficit in Body Corporate Funds.

Identifying the Problem

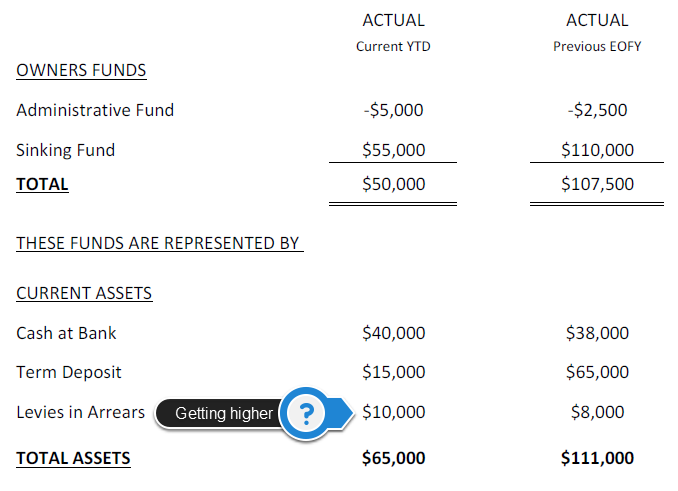

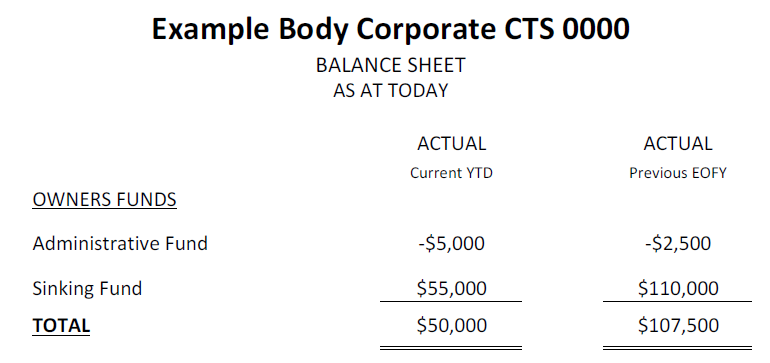

Refer to the Balance Sheet. Look at the balance of the Administrative and Sinking Funds.

If either of the two funds has a negative balance there is deficit in body corporate funds.

Refer to Figure 1 and note that Total Funds is less that the balance of the positive fund.

Deficits in body corporate funds lead to increases in levies, sometimes substantially.

BONUS TIP:

Check the balance of the funds generally.

The administrative fund is for day to day running of the body corporate so it is to be expected that this fund will fluctuate greatly or even empty completely, particularly just prior to a levy issue.

The sinking fund by contrast is a savings account and is expected to accumulate for future capital works. I expect to see a healthy sinking fund balance commensurate with the size of the body corporate. If the sinking fund balance is low, or lower the previous year, as in Figure 1, I would immediately know I’m looking for a record of recent major works.

2. The Value of Levies in Arrears

The Problem

Its common for most body corporates to have some level of levies in arrears. Occasionally levies in arrears can get to a point where it’s impacting the liquidity of the body corporate.

Further reading: Substantial Levies in Arrears

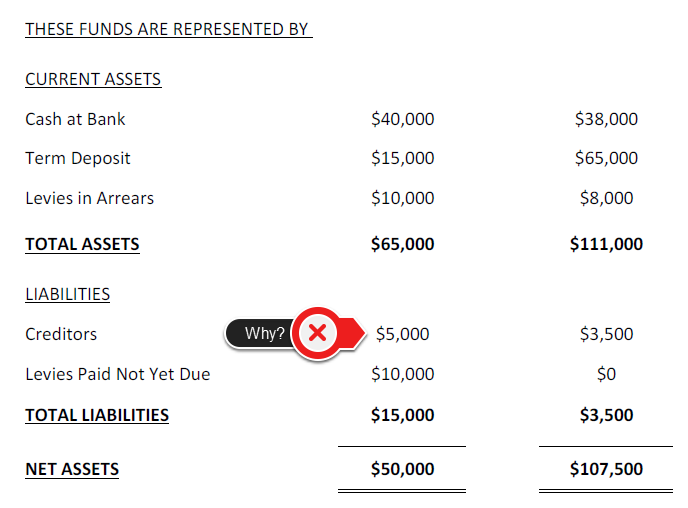

Figure 2: Extract Balance Sheet showing levies in arrears 20% of owners funds (ie $10,000 / $50,000)

Identifying the Problem

Refer to the Balance Sheet. Check the value of levies in arrears as a proportion of the total funds held. Refer to Figure 2 for an example.

Anything over 20 – 25% arrears is going to start having an impact on the operation of the scheme and should give any potential purchaser pause.

Again, why is this happening? It’s possible there may be a majority lot owner.

3. Creditors

The Problem

Body corporates pay as they go. That is the function of the budgeting and levy process.

Consequently it’s very unusual to see creditors on body corporate financial statements.

If creditors are on the statements it may be an indication that a credit contract has been entered into, that there is an ongoing dispute with a contractor or, alternatively, that the body corporate is insolvent (ie doesn’t have enough funds to pay bills as they fall due).

Identifying the Problem

Refer to the Balance Sheet and check liabilities. Refer to figure 3 for an example.

BONUS TIP:

Refer to figure 3, Liabilities and note the $10,000 in Levies Paid Not Yet Due.

The amount is shown on the balance sheet as a liability to offset that it’s also included in the cash at bank to give a clearer image of the body corporates financial position.

Consider the amount in terms of the cash and funds held by the body corporate. If the majority of the next levy issue is paid in advance it may impact on liquidity in the months ahead.

4. Yearly Budget

The Problem

The body corporate budget is “The Bible” around which all expenditure is planned and executed. If amounts are not included in the budget they should not be expended in the current financial year unless absolutely necessary, and then only following approval by the lot owners (even if that approval must be obtained retroactively).

A budget that has overrun will require topping up, either through a special levy or a substantial increase in normal levies.

A budget that is forecast in arrears means the body corporate is deliberately planning to collect less than they require which is contrary to legislation. Effectively the body corporate is electing to have works done which they don’t plan on paying for in the current term, which is dishonest towards tradespeople and shifts the onus for paying to future lot owners, be they the same or different.

Identifying the Problem

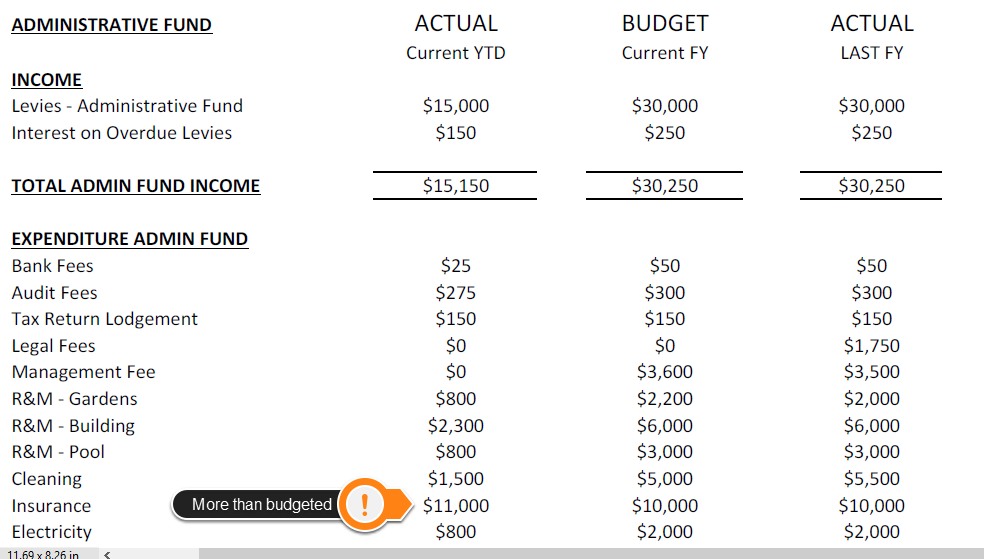

Figure 4 shows an Administrative Fund income and expenditure statement where insurance is more than has been budgeted for

Refer to the Income and Expenditure Statements for Administrative and Sinking Funds.

Look at the projected expenditure vs budget expenditure. Are there categories where the body corporate has overspent? Figure 4 shows an overspend on Insurance.

Any overspends will distort the budget and create a deficit that will need to be recovered.

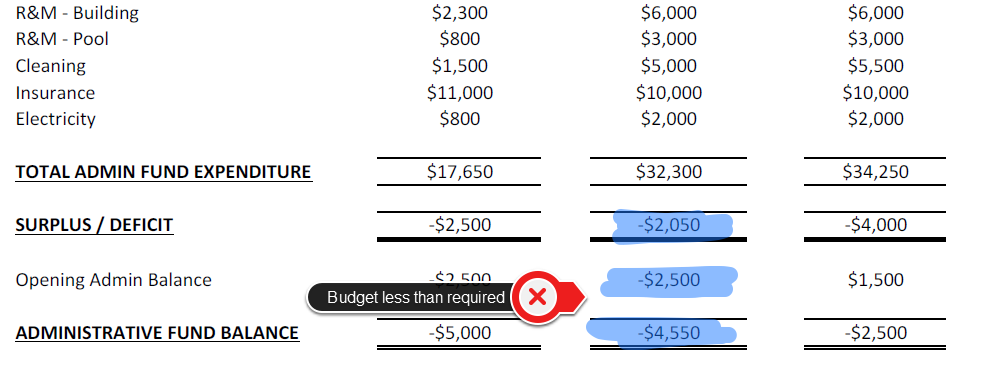

Figure 5 shows an Administrative Fund budget where the body corporate plans to spend more than collected even though they do not have the funds to offset an undercollection

Refer to figure 5 which shows a budget in arrears, meaning the body corporate plans to collect less than their needs.

Under collected funds will need to be made up in the future.

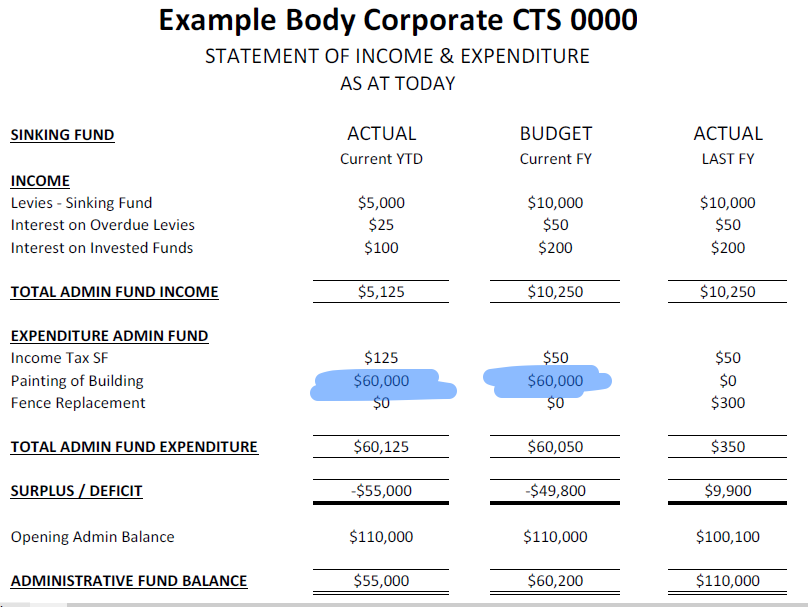

BONUS TIP:

Refer to figure 6 below, the Sinking Fund Income and Expenditure statement and note any major outgoings.

Sinking funds collected are calculated by reference to Sinking Fund Forecasts.

Check the major expenditure was included in the Sinking Fund Forecast.

Unplanned expenditure can empty out Sinking Funds quickly and make it necessary for further funds to be collected.

They’re Indicators Only

Those are the four key performance indicators in body corporate financial statements.

But they’re just that; Indicators. There may be no issue at all, or alternatively the issues may make no difference to you given your personal circumstances. The key is to have all the facts before you buy so you can make well informed decisions.

By far most body corporates are fiscally sound, well managed and maintained to a high degree. Sometimes though there aren’t and there are more serious issues. Finding them is my job and these are the tools I use to help.

Unless stated otherwise all the information on this website relates to Queensland legislation.

Unless stated otherwise all the information on this website relates to Queensland legislation.

Hi there, thank you for the information. We are looking to purchase an apartment in Port Douglas and I have a had a look at the BC minutes for two resorts. One has 800k / and 200k as sinking fund and the other has 800k budgeted for the year and 800k in sinking fund, would this be a red flag.???

Kind regards

Mark

Hi Mark

Outgoings of that sort are challenging but it will largely depend on the reason why the outgoings. So for instance, if its regular programmed expenditure, like for painting, then great, that is what the money was saved for in the first place.

If the outgoings relate to remedial works that’s a lot more problematic. As noted above, those funds are being saved for something. If they’re spent on something else the programmed works will still need to be done but now you have no funds.

Find out what the outgoings are for. Try and get a hold of the Sinking Fund Forecast as well as that will give you the programmed work list.