The most common question buyers ask is What is the body corporate sinking fund balance?

The most common question buyers ask is What is the body corporate sinking fund balance?

What does that really tell you though? A big figure is good, a small one bad? It’s too simple a measure without some context. A clearer question is how much do we have and how much do we need?

This article is about how to find the answer to that question, or, more accurately, as close as you can given we’re looking at forecasts.

Documents Needed

The documents required to check body corporate sinking fund balances are:

- Sinking Fund Forecast

- Current financial statements

- Current annual sinking fund levy (per lot entitlement)

What we’re going to measure is the relationship between the forecast needs of the scheme and actual accumulation of funds.

There are two key performance indicators (KPI’s) we’re looking for:

- The ongoing balance of the sinking fund

- The annual contribution per lot entitlement

A Sinking Fund Forecast is a Capital Needs Assessment

Every Queensland scheme registered under standard, accommodation or commercial module must have some form of Sinking Fund Forecast (SFF) projecting at least nine (9) years into the future.

The forecast must contain an estimate of what works are likely to be needed with a cost and timeline for those works.

For instance: Regular painting of concrete is important for maintaining structural integrity and is estimated to be needed every 10 – 15 years, or, if you’re in a coastal environment, every 7 -12 years.

This schemes forecast should say, in 2020 we will need to paint the building at a cost of $20,000. Currently we have $1,000 so we need to collect $19,000 in three years. Assuming 20 lots, that means a contribution of $333.33 per lot entitlement (assuming equal entitlements), per year.

There are three parts to this example:

- The timeline of works and estimated cost,

- The running balance of the sinking fund,

- The contribution per lot entitlement.

These are the same three things which should be included in every SFF .

How To Check The Running Sinking Fund Balance

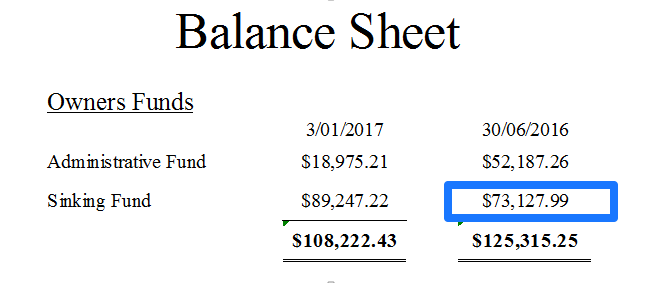

On the Balance Sheet of the current financial statements find the body corporate sinking fund balance at the end of the last financial year.

Refer to figure 1 and note, in this example $73,127.99.

Next find the Cash Flow Tracking table (it may be named something else) in the SFF and look for the corresponding financial year as your financial statements.

Refer to figure 2 and note, in this example $19,127.

Our example looks pretty good. The scheme is estimated to have $19,127 but actually has $73,127.99, well ahead.

Overstatements are rare though so we must look for more context to understand what is happening.

How To Check The Annual Contribution Per Lot Entitlement

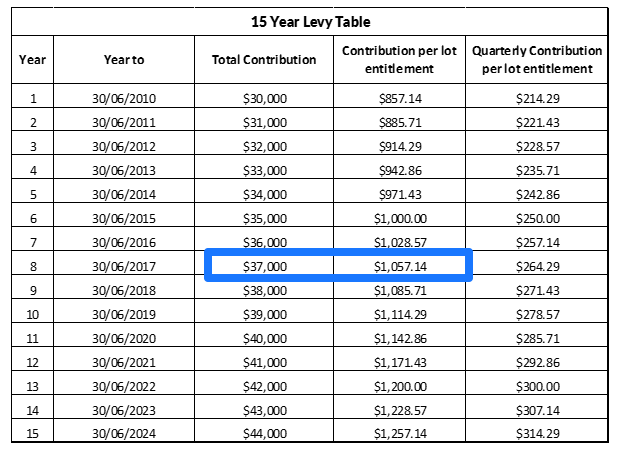

In the SFF find the Levy Table and look for the estimated contribution for the current financial year.

Refer to figure 3 and note, in this example $1,057.14 per contribution lot entitlement per year.

Next look in the AGM minutes for the sinking fund levy issue for the next financial year.

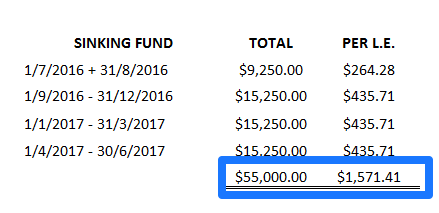

Refer to figure 4 and note in this example $1,571.41.

Refer to figure 4 and note in this example $1,571.41.

The scheme is collecting significantly more than is forecast.

Making Sense of The Measurement

If a scheme has a sinking fund forecast then in the majority of cases they follow the recommendations. How else can they know what levy to set?

That means for most variations there will be a reason.

For instance, in this example, the scheme has more than estimated but is still collecting more than suggested.

What is happening?

If you go back to the Cash Flow Tracking you’ll note that the SFF suggests expenditure of $105,889 for the 2016 financial year. A quick check of the financials will let you know if this amount was spent.

In the scenario above I can say definitively (because I set it up) that the scheme is due for large expenditure but they don’t have enough funds. They’ve elected to increase their sinking fund levies to boost their balance.

They plan to collect $55K for this year, on top of $73K they already have, which will put them in the ball park of $105K to fund the expenditure.

What You Can Learn From This KPI

When I check these KPI’s I’m, usually, doing so on behalf of a buyer. Its part of a group of financial KPI‘s I’m checking to highlight risks for buyers.

Most major issues within a strata scheme will, eventually, have an effect on the sinking fund balance. This simple measure can highlight:

- If the scheme is following the forecast: depending on whether they have more or less it gives hints about the management of the scheme and attitudes of owners.

- If the scheme is likely to need additional funds in the near future: if you’re buying and banking on levies staying the same a body corporate levy correction can be catastrophic news.

- If the scheme is undertaking the capital works suggested: well maintained buildings last longer. Poorly maintained buildings have a day of reckoning.

- If the scheme is paying for additional works not included in the forecast: maybe the scheme has some major defect(s).

- If the scheme is managed and maintained well: the capital works are undertaken within ballpark of when suggested and the balances are tracking nicely with the SFF.

Conclusion

This is a simple check that can be done by committee’s, body corporate managers, buyers and lot owners. I use it hand in hand with other measurements I’m taking in a pre purchase strata report for an idea of how the scheme is likely to perform in the future.

Glaring variations are jarring and more information may be needed. The balance of a scheme’s sinking fund forms part of the value of each lot. A healthy sinking fund is reassuring. A low balance is a read flag.

Lot owners need to watch what’s happening in their scheme and this is one simple financial measure to check.

Unless stated otherwise all the information on this website relates to Queensland legislation.

Unless stated otherwise all the information on this website relates to Queensland legislation.

I have send many written reports claiming this or that amount is in the sinking fund why is I never see a bank statement?

Hi Dave

Even though there are two funds the body corporate has one bank AC into which all the funds are put. Seeing a bank account wouldn’t help much.

When they get larger amounts accumulated some of the funds are invested in term deposit, or several if there are a lot of funds.

The reports provided by the manager are the only way to know how much is accumulated in each fund.

I personally think the law should change and separate accounts for each building. Easier for the auditor etc. Also should be trust accounts with regular audits as real estate agents have too. I have had one case where the BC Manager did not pay the manager and absconded with the funds. Another fund manager in NSW where the onsite manager took over to find less than $1K in both the Sinking and Admin fund (100 + apartment building Caretaking Remuneration $100K+) I would have thought some illegal stuff has happened there. This company manages 70 buildings what a mess.

Lisa,

Thank you for your informative and thought provoking article on sinking funds. I find all your posts very helpful.

From my experience, I agree that the sinking fund issue is not as simple as it might seem on the surface (and as it is often presented to body corporate members). At the rear end of a dysfunctional sinking fund, applying a special levy is a lazy way to paper over a budget that has been continually raided to fund a series of small, non emergency, unbudgeted, pet projects of some committee members. Spending other peoples money on yourself is not an efficient way to deliver goods and services.

Also, I noted with interest your side bar comment: “That doesn’t mean question every action, object to everything or complain, complain, complain.” I guess nobody likes a serial complainer. And some of us do tend to overuse our wonderful right to freedom of expression. Nonetheless, complaints deserve to be heard, and valid ones need to be dealt with. So here goes, I’d like to take you up on the offer to speak my mind.

In my brief tenure as a chairperson and secretary for a body corporate committee, an awful lot of my time was taken up in responding to complaints. This often entailed: interviewing complainants, researching the issue, liaising with the commissioner, crafting a potential response, seeking ratification from all committee members, reporting to the entire body corporate, and dealing with the fallout from dissatisfied complainants.

When I resigned I thought all that drama would be behind me. However, while no longer a committee member, other owners frustrated by a zero official response to their concerns from the current committee, now come to me and ask for assistance in presenting their case. This puts me in an awkward position.

My experience is that committees do not always appreciate their “authority” being either: questioned, clarified or complained about. A self-defined group, indifferent to the needs of all owners is difficult to deal with. They negatively filter, discount the positives, and are readily insulted and offended by questions, opinions or complaints. So much so, that they demonise and punish offenders. Unfortunately, the push back from an offended committee can take the form of ongoing physical and psychological abuse.

It is quite discouraging to see close neighbours resort to any kind of violence. Identity politics can get ugly, tribal and lawless. Mob rule leads to a downward spiral of competitive victimhood. Clearly, living by the legislated rules, and a simple code of conduct, isn’t for everyone. Nor is strata living. It’s a good idea that can be hijacked by some for personal gain and self gratification. A tragedy for the common good. It is not a conspiracy theory if you can prove it. Wishing that it is not so, will do nothing to help solve this wicked problem.

Hi Justitia

Thank you for an excellent description for one of the nastiest and most insidious problems that arise in strata schemes. It is each owners right to complain, and those complaints should be taken seriously.

There are circumstances where the people complaining are simply being a nuisance. Sadly they are a lot rarer than cases of bombastic committees, and body corporate managers, who cannot bear to be challenged on anything.

The core of body corporate legislation is about transparency. There are rules and schemes should be able to demonstrate they are following the rules. Peoples person feelings about being questioned derail the whole process and, as you say, create conflict.

I’m sorry you’re having to deal with that sort of environment. It must be tough.

Hi Lisa,

Last year’s AGM statement of accounts showed our sinking fund was in deficit for around -$300. The sinking fund budget was set at around $360,000 for 2016. Yet painting contracts were signed for over $500,000. Would you say we have a problem? We do not have and have not had an active sinking fund forecast available for the last 3 years. If we do it has never been mad available to lot owners for this period of time at least. Is this in contravention of the BCCM Act?

Hi Barbara

Bodies corporate are free to run their accounts any way they choose, including running a deficit, if a majority of owners agree. As an owner I would certainly hope to see a plan for how the committee plans to fund the balance of the painting works.

Sinking Fund Forecasts are required to be held in the body corporate records. As an owner you may search the records and view the document there, but there is no requirement for it to be circulated to owner. There’s no requirement for schemes to follow their forecast either.

I would suggest if you’re spending more than saving and no longer have a buffer an increase in sinking fund levies may be required. Again though a majority of owners would need to agree.

Once a sinking fund forecast is produced who should or can review it. I live in Queensland and we have a sinking fund Forecast that was produced approximately 3 years ago. We feel it is significantly out of date based on the pricing contained in it. Can the Committee or Committee member perform the review or is there a professional that should be paid to do this? Since this is my first time in a community such as this it would seem that there is always a reaction to increase the sinking fund levy particularly when there is a significant amount to spend on say Painting, I find this difficult to comprehend

Hi Edward

The Sinking Fund Forecast must project nine (9) years into the future for major maintenance and replacement works. That’s about the only guideline though. It can be done by the committee if they choose to do so. Most schemes engage a Quantity Surveyor to do it once every five years, for a fifteen-year period. An update if something unplanned happens may be necessary.

If your forecast is accurate, and the scheme does the works as forecast, there should be no reason for increasing the levies beyond what’s suggested in the forecast. There are a lot of variables in that sentence though and the forecast may be inaccurate, unbudgeted works are completed or the sinking fund levies are not collected in accordance with the suggested levies. All combine to impact on capital accumulation.

Hi Lisa,

If a building has been ear marked for sale and to be demolished within a 5 year period. Can the levies be increased? This is an older building with no mantainence visable seen and no talk of updating anything..body corporate fees have increased to approx $200 per week…I thought if anything they should decrease. Also if the on site manager rights contract has been increased to a 25year period (I have never heard of this, however it has been passed in) and the investors come in demolish the building are the lot owners responsible to pay out the on site managers rights? Or is this something discussed with the investor who buys the building?

Hi Tracey

The body corporate has obligations with maintenance and safety. Regardless the future of the building the body corporate must fulfil those obligations. If it requires more funds then so be it.

I have to say, really weird a 25 year agreement being entered into so close to the scheme being extinguished (the agreements themselves are common). Like you I think its enormously short sighted. I can’t say I know what will happen in the long term but from lot owners perspective any purchaser must buy all the individual lots. Once the purchase has settled you’re out of there and its no longer your issue. Long term the body corporate, the Caretakers Agreements and extinguishing the scheme all become the problem of any purchaser. Once they own all the lots they have enough votes to do everything they choose.

Hi Lisa, I have never seen or any of the Committee a Bank Statement with our end of year statement and voting papers which are sent out by our Management. One would think that an actual Bank Reconciliation Statement should come out to at least all Members of the Committee. Our Management do all the Banking for us as such I feel there should be some transparency as to the money in the accounts in the Body Corporate name. We don’t even know our account numbers. Would be glad to hear what happens with other Management companies. With thanks for your view etc. Dot

Hi Dot

What you’re talking about is pretty common. Most strata managers do not normally forward copies of the bank statements.

It is extremely uncommon not to receive some form of reconciliation report and of course up to date financial statements should be tabled every time you have a committee meeting, or if you’re not meeting regularly, at end of financial year when you set the budgets. A copy of the financials should be included in the Notice of AGM.

There should also be complete transparency: meaning if you’d like to see a copy of your bank statements just ask. They should be able to provide a bank statement at any time.

How does the owner’s corp know if the building insurance has been paid.

Ho does the owners corp know what strata monies are held in the bank

The financial statement provided at the AGM are just a spread sheet with numbers, surely a bank statement should also be provided.

Hi Colin

The most common way to know if your insurance is paid is to have a certificate of currency on file. Its only issued by the insurer once paid. Presumably at any point the strata manager or committee should be able to present a tax invoice and bank statement showing transactions as well, assuming you do a search of records.

As far as I’m aware the legislation in NSW and QLD does not require bank statements be provided at end of financial year. The financial statements must be prepared, and must be audited in QLD, unless owners vote not to audit at the AGM. If audited the Notice of Meeting for the AGM should include the financial statements and audit report. Also, at any time you should be able to do a search of records and see copies of bank statements.

If your strata manager / committee is refusing to supply said information then you should speak with Office Commissioner Body Corporate here in QLD and seek conciliation / adjudication. Sometimes they may be slow in providing but they have no real option not to provide that information.