A deficit in the body corporate funds is a definite red flag as often it’s an indicator of a more serious issue financial issues.

A body corporate is a legal entity, just a like a company or individual, and just like companies or individuals body corporates can run into financial problems, incur debt and be made bankrupt.

Unlike other legal entities a body corporate cannot have a sale or get a second job. In fact in this situation a body corporate only has one recourse to obtain funds and that is through levying the lot owners.

Which is what makes a deficit such a marker: it’s an indicator of a financial issue which will result in increased levies either through a significant increase in levy amounts or a special levy, sometimes both.

What does a deficit look like?

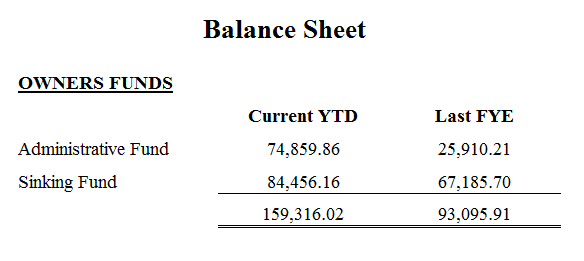

A healthy Balance Sheet is shown at figure 1.

Most, though not all, balance sheets show the last financial year end figures and the current year to date figures. Figure 1 shows positive, increasing balances from financial year end through the current period.

Figure 1: Positive fund balances across all periods

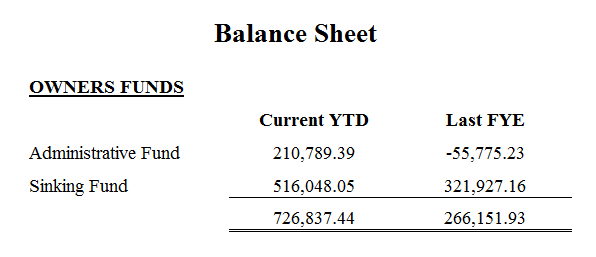

A deficit occurs when the funds held by the body corporate, as shown on the Balance Sheet, slip into negative figures.

Figure 2 below shows a Balance Sheet where the administrative fund has slipped into negative figures at the end of the financial year.

Simply put the body corporate has spent more money than they had available.

Figure 2: A deficit in Administrative Funds at the end of the financial year

What makes deficits in body corporate funds dangerous

The vast majority of body corporates are managed by Body Corporate Managers.

And, most managers open one bank account for each body corporate which contains both Administrative and Sinking funds.

A deficit in one fund then is financed by the other fund. So an administrative fund deficit is financed by spending the sinking funds.

Which is not a problem, in and of itself, assuming the funds are replaced.

Why deficits in body corporate funds arise

There are a number of reasons why deficits arise including:

- Timing issues with collection of levies

- A major project is / has just finished and paid for

- There have been cost over runs on a project

- The budget has been miscalculated, often consistently

- Ongoing financial issues

Timing issues with levy collection

The most common reason for deficits, and what Figure 2 above is showing, is actually a timing issue with levy intervals.

Body corporate funds are collected at staggered intervals throughout the year whilst outgoings are incurred and paid continuous. It’s a bit like only getting paid every three or four months. Immediately prior to a levy issue the body corporate may look like it’s run out of funds, however the next levy issue resolves the matter.

This is something that happens mostly in the administrative fund and levies in arrears can also be a contributing factor here.

A major project is happening / has happened

Similar timing issues can happen in sinking funds when major projects are undertaken.

Funds are organised either through balances held, special levies or borrowing, however the expenditure will likely happen in large chunks at predetermined times, sometimes not in sync with fund collections, leading to deficits.

Cost overruns on projects

Body corporate projects are usually costed out very efficiently, however, any builder or contractor will tell you that unexpected things happen with projects. For example, if you’re halfway through a major renovation and find there’s concrete cancer, it behoves you to fix the issue whilst you’re there.

Cost overruns also happen when projects are poorly planned.

Overruns can affect both administrative or sinking fund, depending on the project underway.

The budget has been miscalculated

Sometimes deficits arise because the cost of running the body corporate has increased however, the budget, and consequently the levies, have not increased commensurately. The body corporate is spending more than they’re taking in and the deficit increases rather than being recovered.

Budget miscalculations tend to be ongoing since they often result from downward pressure on levies by the collective lot owners.

Ongoing financial issues

Occasionally a deficit can be an indicator of something more financially dire, like ongoing major capital needs due to building defects that have exhausted the body corporate’s collected funds or an under collected sinking fund over a number of years.

Deficits in body corporate funds mean levy increases

Any overspent funds need to be recouped immediately.

There are two ways of doing this – a special levy or an increase in the levy issue for the overdrawn funds, possibly both.

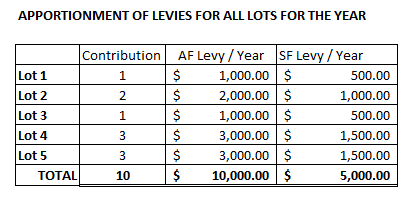

For instance, say the admin fund budget for the year is $10,000 and the sinking fund $5,000, collected as set out in figure 3.

Figure 3: Yearly levies collected by lot

If during the course of the year the body corporate spent an extra $2,000 in administrative funds then a deficit would result. To recoup that deficit the body corporate could:

- Issue a special levy to collect the $2,000; or

- Increase the budget in the next financial year to $12,000

But, if the extra $2,000 spent reflects actual ongoing costs of the body corporate then the body corporate could:

- Issue a special levy to collect the $2,000 and increase the budget for the next year to $12,000;

- Or, increase the budget for the next year to $14,000.

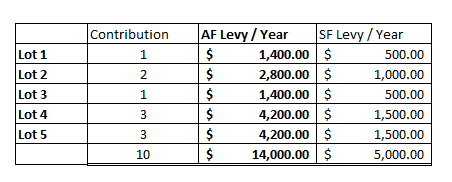

Both achieve the same thing and the new levies look more like figure 4, including a substantial increase.

Figure 4: Yearly levies collected with increased administrative fund

If there is a deficit

Any time I see a deficit in body corporate funds its a warning bell to me to look for something deeper going on.

At best it’s a timing issue and has already been resolved.

However, worse case scenario, the building has been underfunded for years and now has severe building defects and minimal funds to deal with the issue. The costs could run into the $100,000’s.

What is most likely is the deficit will be addressed eventually, through some sort of increase. How frustrating to be a new owner having to pay an increase to cover previous owners who paid too little.

If your body corporate record search highlights a deficit in body corporate funds ensure you get a handle on what’s causing the deficit so you can make an informed decision about what may be happening. In some cases it’s not an issue and it may even put you in a good bargaining position. The point here is to be aware.

Update 31/10/2013:

I saw a great article today where Chris Gray of Purchase or Pass? discusses just this point. See below for details.

I would note that the discussion of increased levy issues bringing the funds back into line are true but don’t seem to take into account that those funds are actually spoken for. Unless the budget includes the recovery of part or all of the deficit, then it’s likely that over the term of the levy issue the fund will end up in arrears again.

Certain things stand out as red flags in body corporate records. A red flag is not necessarily a reason not to buy a property or even an indictment of that body corporate or it’s management, more a highlight of something that could be an issue and needs more investigation and consideration. If a “red flag” is highlighted in your body corporate records search please consult with your solicitor.

[…] Further reading: Deficit in Body Corporate Funds. […]