Special levies happen in body corporates more often than you might think, and, for some lot owners it’s “the final straw” and the reason they decide to sell. Does that mean any new owner automatically becomes responsible for paying those special levies?

Special levies happen in body corporates more often than you might think, and, for some lot owners it’s “the final straw” and the reason they decide to sell. Does that mean any new owner automatically becomes responsible for paying those special levies?

As with most things in the body corporate industry, it’s depends. It will depend on:

- Whether the special levy is already issued; and

- How many special levies are issued; and

- When the payment(s) are due

Remember that any levy issue must be resolved by a resolution at a general meeting. For the purposes of this discussion I will assume that motion has been passed and that the motion was valid.

How levies are treated at settlement

Levies in a body corporate are an ongoing lot expense, meaning they never stop being issued and they’re issued to the lot account. The changing of a lot’s owner has no impact at all on the levies and how they’re treated by the body corporate.

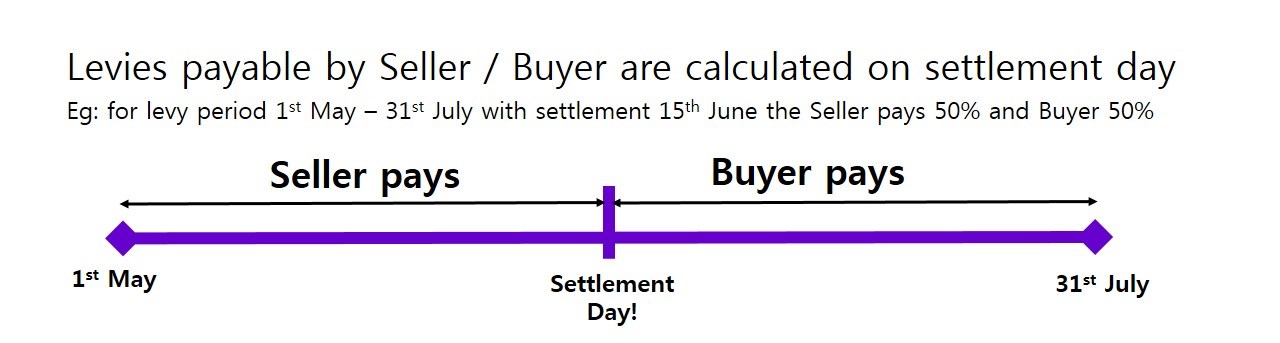

At settlement then, as ownership passes from one owner to another, the levies payable by respective parties are calculated on a pro rata basis. Think of it like a continuous timeline: the Seller pays up until the property is settled and then the Buyer pays.

An example:

- The property settled 15th June

- The last levy issue was for the period 1st May – 31st July a period of 92 days

- The Seller pays from 1st May to 15th June, or 46 days

- The Buyer pays from 16th June to 31st July, or 46 days

- If levies are owing at settlement a cheque is drawn for the body corporate from settlement funds. If the levies have been paid by the lot owner then the pro rata amount is added to total funds payable for the purchase to settle.

Pro rata settlements of both rates and body corporate levies are dealt with in the same way, since the charges and the way they’re issued is fairly cut and dried.

Unfortunately it’s not so clear cut with special levies, because they’re, well, special cases.

Determining who’s responsible for special levies

Every special levy issued is individual. They vary considerably from scheme to scheme and even incident to incident.

They may be issued in one lump sum or in ongoing payments over several levy periods. They can be due immediately, due at some period in the current financial year or not due for many years to come. Some have prompt payment discounts, some do not.

Special levies are as variable as body corporates themselves.

Which makes it all rather difficult to establish on a timeline who’s responsible for what and when.

Particularly from the body corporates perspective.

Levy notices are issued to current lot owners. When lots are bought and sold the body corporate must be notified that the lot owner has changed. They will then send the next levy notice to the new lot owner.

Notice there’s no discussion here of pro rata within the body corporate. The lot owner, whomever that may be, owes the funds owing on the lot account regardless of whether or not they were the lot owner when those debts were accrued.That’s why it’s so important to clear levies at settlement.

Who pays what is irrelevant to the body corporate since as far as they’re concerned the lot owner pays.

Negotiation is key

Who pays what with regard to special levies is a matter negotiated between the Buyer and Seller, or more likely each party’s conveyancer.

- If the special levy has already been issued to the Seller, and it is a one off lump sum payment then it is the Sellers responsibility. This is the option most conveyancers will work with, simply paying whatever is owed

- If the special levy is multiple levy payments over a number of periods, some of which are unpaid the special levies will be pro rata per what has currently been issued to the existing lot owner

- If the special levy has not yet been issued to the Seller, and it is a one off lump sum payment then the Buyer will be responsible. It’s a good idea to negotiate a reduction in the purchase price to offset the levy

- If the special levy is to be issued sometime into the future I would accept that as Buyer responsibility, assuming it’s fully disclosed of course

…all depending on why the special levy was raised

I personally would be very interested in why the special levy is issued as it would help me identify my negotiation strategy.

There can be many reasons special levies are issued, but, some of the more common reasons are:

- The property is being refurbished

- The property has major, costly building defects for which funds are not available

- The body corporate has a deficit in the administrative fund

If the property is being refurbished as the Buyer I can expect to obtain significant benefit from that, consequently I would be happy to contribute a substantial share of the cost.

If the property has major, costly building defects for which funds are not available I would want to know why and what else has happened before deciding how much I am happy contributing.

If the property has a deficit in the administrative fund I see no reason I should contribute at all. The body corporate is seeking to recover funds overspent in previous years. In my opinion the Seller should cover this cost and I would negotiate that settlement.

Conclusion

Lots in body corporates come with plenty of rules and regulations but not with regard to the real estate transaction itself. Parties are in a position to negotiate what suits them, and payments of special levies should definitely be negotiated.

hoto credit: Philippe Put via photopin cc

Unless stated otherwise all the information on this website relates to Queensland legislation.

Unless stated otherwise all the information on this website relates to Queensland legislation.