Pre-issue body corporate levies, or interim levies as they’re sometimes called, are a response to the peculiarities of the end of financial year process for strata schemes.

Pre-issue body corporate levies, or interim levies as they’re sometimes called, are a response to the peculiarities of the end of financial year process for strata schemes.

Body corporate end of financial year systems are different from the majority of the rest of Australia. The end of financial year can be any month in the year.

In Queensland a schemes end of financial year will be the month prior to the month they were originally registered in. So if a body corporate is first registered in February, their end of financial year is January 31st. If May, April 30th.

End of financial years may be varied with a motion at general meeting and an Adjudicators Order.

Why bother? Changes can be made to match other schemes in a group or because an AGM falls at an awkward time, like Christmas.

Why bother? Changes can be made to match other schemes in a group or because an AGM falls at an awkward time, like Christmas.

Levies & End of Financial Year

Levies may only be issued for one year at a time. That’s because each year the body corporate is required to prepare a new budget with reference to the previous year’s budget so that any deficits may be addressed.

For instance if a deficit in funds has arisen it should be recovered in the next year. Equally if a surplus of funds is on hand then it should be utilised to minimise the next round of levies.

Three months is allowed for this process.

What that means is that in each 12 month period there will be three months where no levies have been issued.

You might be thinking, yay, no levies, but it’s not quite that simple.

A three month period without any levies would be devastating for a schemes finances. Imagine if you didn’t get paid for three months! You would not be happy. And if would compromise your ability to do… stuff.

It’s the same for a body corporate except the “ability to do stuff” will include things like having the elevator arrive when summoned or the gates open when you enter the code or click your buzzer.

An interruption in income is a serious problem.

Pre issue body corporate levies

The solution that most body corporate managers use is to raise a pre issue body corporate levy.

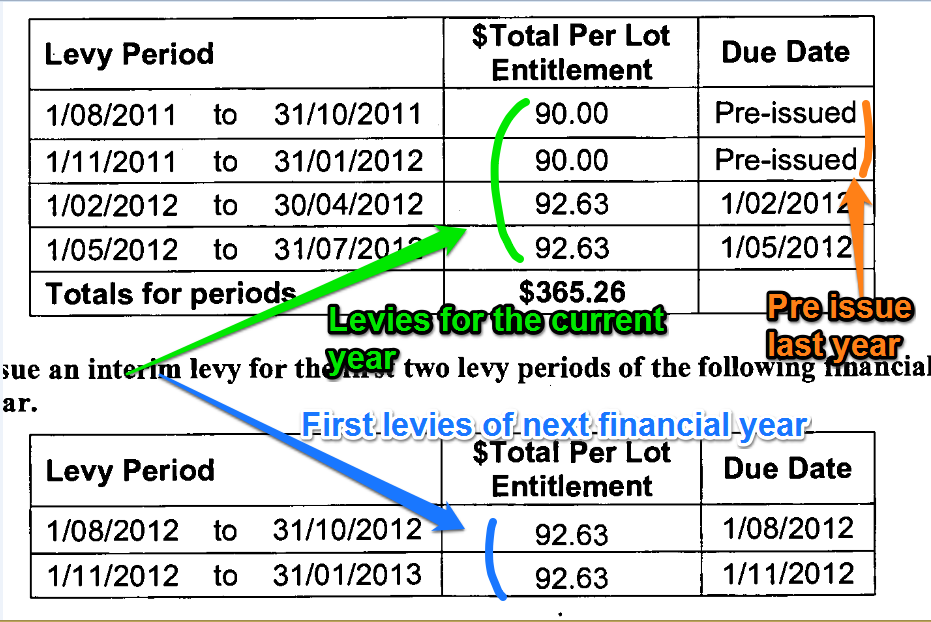

Body corporate levies as they’re voted on at the AGM will look something like this:

In this case four quarterly levies are approved for the year 1/8/2011 – 31/7/2012 at a total of $365.26 per lot entitlement. The actual levies dollar value each lot would pay will depend on contribution lot entitlements.

Underneath the years levies is another set of levies for the next financial year are raised, in this case for the period 1/8/2012 – 31/1/2013. These are pre issue body corporate levies.

Notice in the yearly levy issue that the two at the top are the pre issue from the previous year.

Pre issue levies can be and indeed are issued with quarterly, four monthly or half yearly levies. In most cases only one pre issue is raised.

Does every body corporate have to do this?

Legislation allows that the body corporate can raise an interim levy to maintain cash flow, but there’s no requirement for it to be in the form of pre issue body corporate levies.

Which means the body corporate can just go ahead and send you a bill for the first period of the financial year, no questions asked or discussion needed. The pre issue would then be confirmed when full year levies are voted on at the AGM.

There isn’t actually any need for pre issue body corporate levies at all.

Further, once the budget is adopted and the levy issue agreed upon at the AGM that is the body corporate’s levies for the year and there should be no variation. At least not without another motion passed at general meeting.

The same does not apply to the pre issue body corporate levies. Body corporate levies can only be issued for one year, so pre issue levies are actually subject to change.

So why do managers do it then?

Although the pre issue can be altered if circumstances change it is very uncommon.

The reason levies are issued this way is because it really is simpler for management and lot owners alike to just follow the script.

It works for body corporate managers who have multiple departments handling different functions. It works for lot owners who need to be able to budget to pay their levies.

In short it promotes certainty and confidence, both good things.

Unless stated otherwise all the information on this website relates to Queensland legislation.

Unless stated otherwise all the information on this website relates to Queensland legislation.

Thanks for your article.

I didn’t understand the last section “Does Every Body Corporate Have to Do This?”

Wouldn’t every OC have to pass a motion for Interim Levies because otherwise they have no permission to issue levies?

Thanks.

Hi David

Queensland legislation allows bodies corporate to issue the first levy period of the new financial year at the same rate as that issued in the last levy period of the elapsed financial year.

So, it doesn’t need to be done, but gives better control over budgets and information to owners if they do.