6 Indicators of a Body Corporate Levy Increase

One of the things I see often in body corporates looks something like this: Period Admin Budget Sinking Budget Total To Raise FY Ended 6/2014 $200,000 $50,000 $250,000 FY Ended 6/2015 $170,000 $100,000 $270,000 What this shows is that there has been a 50% increase in sinking fund budget from one financial year to the […]

Body Corporate Levies: Why Are They So Expensive?

One of the first questions people ask when they’re buying a unit is “how much are the levies?” It’s a smart question because it does no one any favours to buy a property they can’t afford to hold. The body corporate levies are a large part of those holding costs. Savvy buyers take the current […]

Who Pays Special Levies: The Buyer of The Seller?

Special levies happen in body corporates more often than you might think, and, for some lot owners it’s “the final straw” and the reason they decide to sell. Does that mean any new owner automatically becomes responsible for paying those special levies? As with most things in the body corporate industry, it’s depends. It will […]

Body Corporate Levies and Prompt Payment Discounts

Body corporate levies are different from other sorts of accounts; they attach to the lot rather than the lot owner. This is because a body corporate isn’t offering a service like a Strata Manager, or selling a product like Telstra. A body corporate is managing the affairs of a building for, and by, a group […]

Has There Been A Contribution Lot Entitlement Change?

When a body corporate is registered the schedule of interest and contribution lot entitlements are set out in the CMS. But who sets those lot entitlements? The first lot entitlements for any body corporate are set by the developer. Now days contribution lot entitlements are required to be equal, unless being equal would then result in inequity. But […]

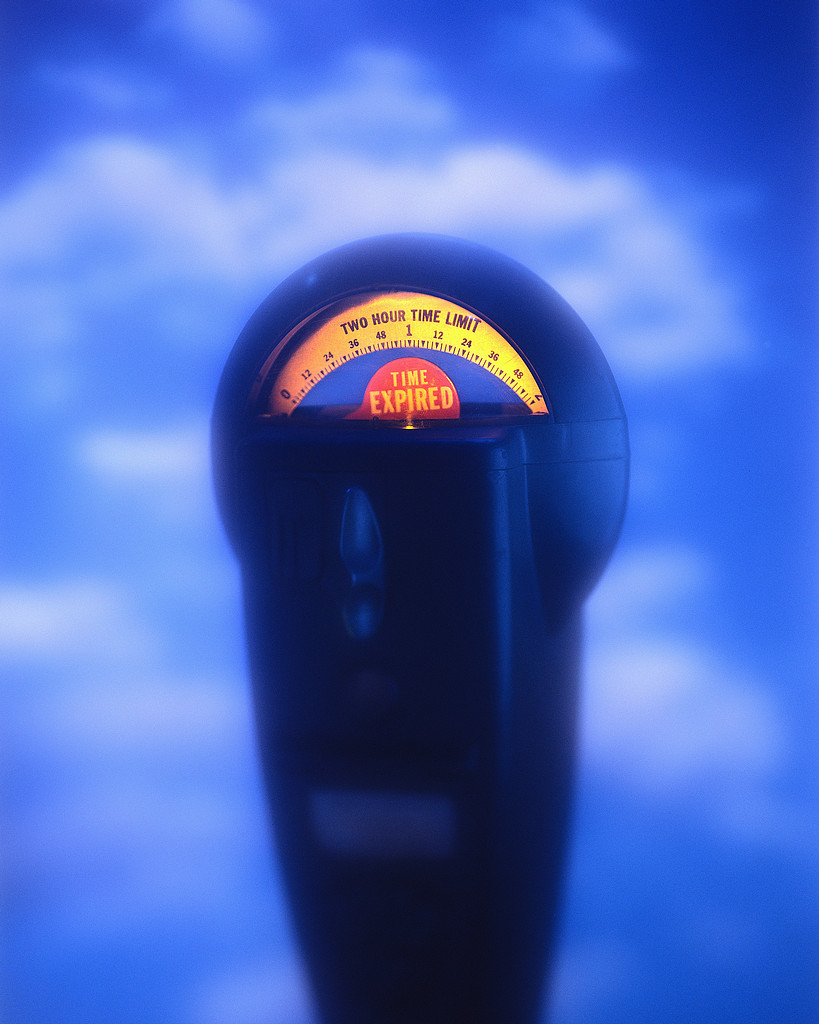

Body Corporate Levies & Expired Current Levy Year Issued

Body corporate levies are set on a year to year basis, three months after the start of the new financial year. For reporting this creates issues. Sometimes a disclosure statement or records search will quote levies for a period that has expired. For instance, say the levies are quoted to 31/7/2012 and yet the date of […]

The Importance of “Levies Paid To” Date

When I bought my first house I found the whole process very stressful; exciting but stressful. So stressful in fact that when all was finally organised and executed and we moved in I realised I’d forgotten to get the power turned on. Luckily there was still power at the house so, score! The next day […]

Body Corporate Levies

One of the most common misconceptions about body corporates is that they are overcharging for levies or somehow making money off the lot owners. I’m never really sure what nefarious purpose people think is going on, but it’s not at all what’s happening. Body corporates are heavily regulated in almost every aspect and levies more […]