Mention the word body corporate and most people immediately think of levies.

Mention the word body corporate and most people immediately think of levies.

I’m convinced it’s the one thing that everyone knows about body corporate’s that’s actually correct. Every body corporate does issue levies.

What amount those levies are is vastly different from building to building.

I’ve seen levies per lot as low as $55 per year and as high as $25,000.

Body corporate levies are a very individual thing. And that’s because different buildings have different facilities, different levels of repair, even differences in the make up of the residents, which will all effect how much the levies for a building are.

The Budget

Every body corporate has a budget.

People have budgets or guidelines for their spending but in the world of body corporate’s it’s not a budget, its “The Budget”.

It’s important. In a lot of ways it’s the bible.

Once the budget is set every financial decision made by the body corporate in the next financial year will be considered in terms of whether or not that expenditure is factored into the budget.

The key reason for that is that the budget is the body corporate levies for the year.

The process

Every year the Committee sit down to consider the body corporate’s needs. They consider everything (or at least they should; committees are made up of people, some who’re good with money, and some who aren’t) from costs to run the building like electricity and cleaning, through bank fees, management costs and any ongoing issues.

That amount is totalled up and that becomes the Administrative Fund Budget.

Most buildings will have some form of Sinking Fund Forecast that projects the future capital cost of the building. The Sinking Fund Forecast is considered along with any capital unscheduled outlay the committee wants to address.

That amount is totalled up and becomes the Sinking Fund Budget.

The budgets are divided by the aggregate lot entitlement and that becomes the levy issue.

The budgets and levy issues will be put to the owners for vote at the AGM. Once approved the levies are set for the next financial year.

How to calculate body corporate levies

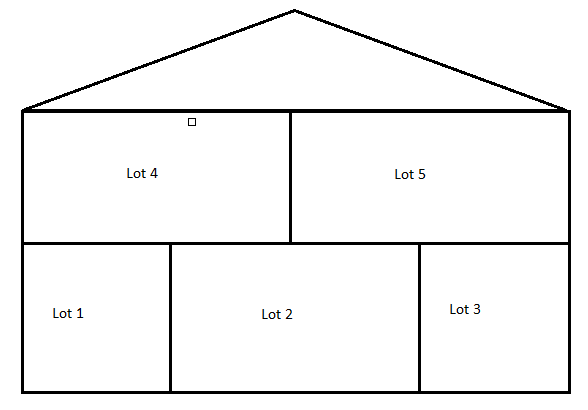

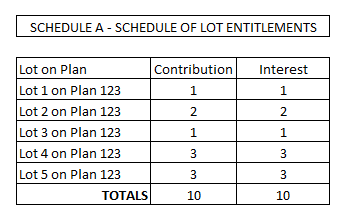

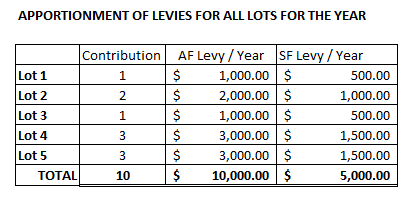

Say we have this body corporate with lot entitlements like this.

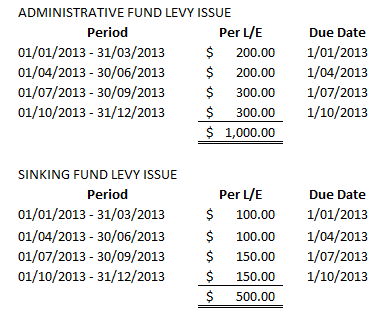

The committee have forecast administrative fund budgeted costs for the year of $10,000 and the sinking fund budgeted costs for the year of $5,000. The body corporate wants to collect those costs evenly over the year.

The levy issue as put to owners at the AGM will look like this:

The total administrative fund budget of $10,000 is divided by the total contribution lot entitlements, 10, which gives an amount of $1,000 per lot entitlement to be collected.

The same calculation is done with the sinking fund budget – $5,000 / 10 – giving an amount of $500 per contribution lot entitlement to be collected.

My example body corporate here is collecting levies quarterly and there is not discount.

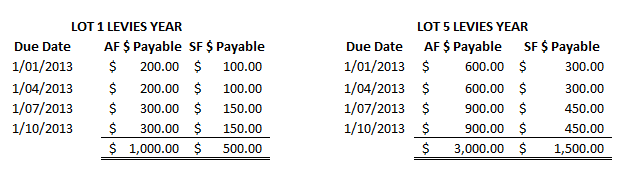

To calculate the levies payable the amount for each levy issue is multiplied by the lot entitlement of each lot. Lots 1 and 3 have lot entitlements of 1, so they pay the amounts as set out in the levy issue. Lot 2 pays double, and lots 4 and 5 three times.

The figures above show levies payable for lot 1 and lot 5 for each of the four periods throughout the year.

The figures below show how much each lot will pay in total for the year.

Conclusion

Above is a very simplistic example of how levies are calculated; I’ve not taken into account discounts, previous fund balances, deficits or surpluses.

In reality calculation of the budget is a complex and time consuming process, particularly when some body corporate budgets can run into many millions of dollars.

It’s no wonder then that most body corporate managers employ Accountants and bookkeepers to manage finances.

Unless stated otherwise all the information on this website relates to Queensland legislation.

Unless stated otherwise all the information on this website relates to Queensland legislation.

I am an owner of a lot in a commercial bldg of 6 units.1 family owns 4lots individually so any motion can be pasased with their vote. A motion was passed a special levy to be pd by 16.5.14 and then 7 levies quarterly tills march 2016.Each ofthe levies is $8852 per lot.This if for repairs to the building. My point is can a motion classed as ordinary be passed for special levies so far in the future? The body corporate admin.and sinkingfund levies are yet to be set.

Hi Shirley

It is certainly possible for a body corporate to pass levies into the future, even several years into the future. They may also be issued separately from regular levies.

There may be some issue as to whether or not the resolution should have been a special resolution. There are specific spending limits for both committees and body corporates as a whole. It’s possible that an issue of such a large levy should have been a special resolution. Having said that, Commercial modules do have a lot less rules that other regulation modules. It’s considered business people don’t need as much protection as regular investors.

The best person to definitively answer if the resolution should have been a special resolution would be the Commissioner Body Corporates. They are the experts in deciding meeting resolutions and they should be able to give you some idea how similar issues have been dealt with, if at all, for free, prior to lodging an application. There’s a link to Commissioner BC on the sidebar.

I hope that’s helpful.

LISA

I live in a block of 6 levels. The floor plan is the same for each unit above and/or below. Levies are not calculated equally (per square meter) but on the higher you live the more you pay, (for the better view). Is this allowed as the amount is substantial ?

Hi Scott

Levies are never calculated by square meter.The levies should always be calculated on the contribution lot entitlements of the scheme. Check the Community Management Statement (CMS). Lot entitlements are set by developers and recorded in the CMS.

Nowdays new schemes are required to have equal entitlements except where it would be unequal if they didn’t. The calculation is based on exposure to common property; so for instance a two bed with two car spaces and a three bed with one car space might have similar entitlement.

Older buildings often had unequal contribution lot entitlements set by something like “the higher you are the more you pay”. That led to contribution lot entitlement changes being pursued through Adjudication and courts. Courts have found there must be a reason for the inequality or a change is ordered.

Hi I live in block of 24units they are mostly 2bedroom and a few with3 bedrooms all have garage should fees be the same for everyone and also I had a raise of $130 from last year and there is also a difference of $115 which I am to pay why would this be and who decidides how much fees should be every year thank you

Hi Paula

The budget is decided each year by the committee. The budget is then divided between the owners by contribution lot entitlements.

Both budgets and contribution lot entitlements are different for each scheme. I can’t comment on what might be driving an increase in your scheme as I don’t have any specifics on budgets or entitlements. Most increases are because it costs more: CPI increases affect bodies corporate as much as individuals.

Hi Lisa

There is quite a large surplus in the administration fund but the “treasurer” does not take this into account when preparing the budget. It is totally ignored therefore making the levies for the administration fund very expensive. What can I do about this? I have looked at case law and it appears that the admin fund is not to be used for savings (see 25 Queens Road). What can I do to convince the committee that they should be reducing the budget by the surplus amount?

cheers.

Hi Lesley

Yes the Admin fund is not to be used for savings. As practically as possible it should be cleared out each year.

In your position I would take the budget as presented, calculate how much I believe the administrative fund levy should be after deducting the saved funds and either: 1) write to the committee outlining your objections including the reference to orders (though not sure which one you meant) and request they recalculate, or alternatively, 2) put forward a motion for general meeting that the levies be recalculated to take up the savings.

If you do one or even both you can then make an application for adjudication that the levies be amended to what you believe they should be.

I have just had a AGM, with much prompting we were told that there is a surplus of $13000.00 in Admin Fund, however they are seeking to increase the Admin fund again. Strata company was suppose to establish a saving account in 2104 when they increased the levies 400%, this never happened. What advise can you offer.

Hi Ronwyne

You need to refer to the budget for the year – it should be included in your Notice of AGM. Its possible the surplus is forecast to be used up during the year.

If not and they simply plan to increase the surplus here in QLD I would recommend making an Adjudication application (must be within 3 months) that the levies are too high and the motion should be voided. If its upheld then the scheme will need to hold a new general meeting to set new levies.

I’m not sure what you mean by savings account. Again, check the financials and see what the scheme has been spending money on.

Hi Lisa

I am an agent attempting to sell a unit in a body corporate, which has BC levies much higher than would be expected with such a property. It is a mixed use property with 6 identical residential units all with 48 entitlements (total 288) and 5 commercial units with various entitlements (total 712). An examination of the sale contract reveals that each of the residential units are paying approximately 3 times what they should be if the budget was evenly distributed along entitlements. The fact is it would appear that the commercial owners are paying nothing. Can this be legal???

Hi Terry

If the total aggregate of contribution lot entitlements across the whole scheme is 712 then each residential lot should be paying 48/712 of the total administrative and sinking budgets.

Its possible the commercial lots are in a different body corporate and the budget relates to the residential only. If the commercial units are all included in the body corporate then no, it is not in compliance with legislation. Levies should be calculated based on the contribution lot entitlements of the scheme. There aren’t any circumstance where a lot would be exempt from paying.

If you genuinely believe there has been a mistake I would suggest the owner discuss firstly with the body corporate manager or Treasurer and if no satisfactory explanation is given then the Office Commissioner Body Corporate.

Hi I just bought a unit (1 of 3 ) it does not have a body corporate only body insurance, I have been told that the maintenance costs are split 40/30/30 I am the smallest out of the 3 ( half the size from the unit above me ) but was told that it goes according to bedrooms , One apartment has 3 bedrooms and the others have 2, does this make any sense ?

Hi Chris

Your units do have a body corporate or they would not be able to be sold individually. A body corporate is created when the land is subdivided creating the separate titles. The body corporate is run by the owners. Your other owners are doing this as well, hence the telling you of the ratio for costs, just informally.

There’s a couple of things that will affect maintenance costs: The contribution lot entitlements of the scheme and the plan the scheme is registered under.

Contribution lot entitlements define each lots percentage payable of the costs. It is not defined by how many bedrooms a lot has rather is predetermined and contained within the Community Management Statement for the scheme. It can be changed, but only by resolution without dissent – ie full agreement of all owners – and then to take affect the change must be registered. Get a copy of the CMS to work out what ratio of costs each lot pays.

The type of plan will help work out the boundaries between common property and the lots. Each owner is responsible for their own lot, the combined owners jointly responsible for common property in the ratio set out by the contribution lot entitlements.

Hello Lisa, how can one get hold of a copy of the Community Management Statement you mention?

Thanks

Hi Luke

You could ask your body corporate manager for a copy. You may also purchase online if you have the CTS number. I charge $77 and there are other options online as well.

I have the second largest lot entitlement of my residential building, 3 bd, tandom garage compared to others with 2 bd 1 car. i can understand why the Sinking fund should be apportioned by lot entitlement for future capital works. I don’t understand why administrative fund is calculated by lot entitlement for the maintenance of the common area, operational bills etc. Eg Other 2 bd which may have 5 occupants, use the common area alot more then the 2 of us in my apartment yet i pay almost double. Doesnt seem fair.

Hi Brett

As it turns out the team who’re reviewing QLD legislation agree with you. The recommendation is that contribution lot entitlements are abolished altogether and only contribution lot entitlements remain. These are all still idea that’s are being mooted obviously however why commission a huge report if then the legislation ignores the recommendations.

Our Body corporate has been operating for 25 years.The levies have been sinking fund , admin fund and 3 a caretakers levy

The caretakers levy has never been charged on the caretakers unit .At the last AGM the Body Corporate Manager lumped the caretakers levy with the admin fund .This doubled the levies for that lot.

Your advice please if this is correct

Hi Alan

That is very odd. The Caretaker is a lot owner and should always be contributing to the costs of the scheme, including the Caretaker. As a lot owner benefit is derived from the actions of the Caretaker both in terms of current facilities and future property gains. That the Caretaker and lot owner are the same person is irrelevant. They are two separate entities.

There is no need for a Caretakers levy. The cost should be included in the admin fund levy and paid by all the lots.

We have purchased a brand new unit in a block of 3. The developer has set up a body corporate with a company and they say it is locked in for 3 years. All owners told developer we wanted to do our own body corporate. The firm is charging the 3 of us $2666.00 per year but we want out of what developer set up. What can we do ?

Sorry $26660.00 for each unit $8000 pa

Hi Craig

If the contract was entered into by the developer when they were original owners then its most likely a valid appointment, depending on what state you’re in.

$8,000 is a whopping amount though, especially for 3 units, so that doesn’t sound right at all. Are you sure $8,000 isn’t your total budget? That would be more correct. Ignoring the management cost you’ll be surprised how much it costs to run a scheme, particularly as you’re accumulating capital funds as well.

This is contract law. BC law can help with the appointment itself, but, if it is valid, then refer to the contract to see what remedies you have for termination. Also discuss with the strata manager. They may be bitchy about it and insist on either being paid out or running its term but they may surprise you.

Hi Lisa,

Am I able to ask and receive information regarding Contribution Per Unit of Entitlements for all units within my complex from the Body Corporate Manager.

And am I able to ask and receive a Community Management Statement from my Body Corporate Manager?

My levies do seem extremely high and I am very interested in knowing other units CPU of E?

Regards,

Andy

Hi Andy

You can certainly ask your body corporate manager for a copy of the Community Management Statement. They might charge you a copying cost (72c per page) or they may just email it to you.

Once you have it, check out schedule A for lot entitlements.

You might also want to look at the financial statements. They should give you the budget for the year.

Lisa how do we calculate our levies on the 4 villas of equal size.

Hi David

Have a read of this article about budgets.

The total budget for the year is divided by the contribution lot entitlement aggregate and then multiplied by the contribution lot entitlements of each lot. This article tells you more. Refer to your Community Management Statement for entitlements.

On a new High rise building do I have to pay extra for lots on same project on top of my Owners Corporation Fees and than wait for a refund ?

Hi Peter

I’m not sure I understand the questions here. You should be charged one set of fees for Owners Corporate costs and that’s that. You can be asked to pay extra, though all lots should be levied the extra. I’m not sure in what circumstance you would be get refunded?

we have been owners of the largest lot of a retail complex but have been told by BC that we are not BC members. Is this true? When we purchased the lot we had to $70k for QFES to install a fire hydrant at the front of the complex for all lots to use as it was out dated and not compliant, BC paid nothing and reimbursed nil back to us. Is this the owners responsibility? Last year our BC levies were $12k. This year it increased to $22k. Is it lawful to raise levies excessively high? Appreciate your advice.

Hi Fransis

It sounds like you might have a volumetric lot that is covered by a Building Management Statement. As such you won’t be a member of the body corporate, but rather a separate lot within the same precinct sharing facilities with a body corporate.

The Building Management Statement sets out who is responsible for paying what in regards shared expenses. The Building Management Group should meet regularly as well, and you should have a say in that group. I suggest you get a hold of the BMS and see if you can get minutes of the BMG meetings. If they’re raising levies as you suggest there will be budgets as well and you should get a look at them. The budgets themselves determine what you pay in levies, and yes, the scheme must raise as much as they need, regardless how high that might be.

If the fire hydrant is in your lot then it will be your responsibility to maintain. If its being used by the body corporate or all lots then presumably the BMS will set out the proportion owing by each user. Again, get a copy, have a read and see what you can find. It might be that you can raise an invoice to the body corporate or other lots to recoup some of the cost.

Should each unit in a retirement village be calculated equally – ie $10 per square metre or would it vary according to position of unit (ie facing N/E , ist floor or 3rd floor

Hi Esther

No the contributions are not calculated that way. Each unit is allocated a contribution lot entitlement, which combined make up a ratio. Contributions are calculated and paid per the contribution lot entitlement of the scheme and its lots.

Hi Lisa,

I have a 2 bedroom unit in a block of 16 units, 14 are small studios, 1 is a standard size 1 bedroom unit. The OC fees are based on area, I pay $6500 a year, the studios $1,750. There are zero amenities, except an electric gate which my unit does not get any benefit from as my park is in front of the building but off street. I pay approximately 4 times what a studio unit pays. Given I only have 2 bedrooms, I pay comparatively a far larger rate of fees per bedroom. I imagine it will be difficult to convince the 14 studio owners to pay any more than they currently do. It seems a touch unfair to pay it based on area in my view. Can you advise a path forward? I thank you for any assistance. Ash

Hi Ash

The percentage you pay of body corporate costs is calculated using lot entitlements. In NSW these will be on the title for the OC. Here in QLD there are contribution and interest entitlements and these are set out in the CMS.

Levies should not be calculated on anything other than these lot entitlements, and that is true of both QLD and NSW.

The entitlements can be challenged in court. There is a lot of precedent for amendments being made, based on the particular circumstances of each scheme. Here is QLD amendments to lot entitlements are a major issue, as they do directly affect who pays what. Maybe discuss with your OC to start off with. Maybe commission a report on entitlements. Once the report gives its findings it can be easier to proceed.

Any amendment of lot entitlement requires a resolution without dissent of the OC. That doesn’t happen often so you can also seek a court order.

Hi Lisa

A few months ago I discovered that our Admin Fund was heading for an $80k to $100k surplus (turned out to be $108k). The committee believe they are collecting levies in one financial year to pay the insurance in the following year – insurance is due in the first month of the financial year. I pointed out that this is in contravention of the Act but even the BC manager backed the committee.

Now they have sent out the AGM papers for the new financial year with no mention in the budget of the $90k they have already paid for this year’s insurance. Instead they have mentioned in notes that they have used the surplus to pay the premium. They seem to believe they can incur expenditure without a corresponding budget item.

Who is correct? Me or the committee?

Regards ….

Hi Terry

If the financial year ended with a surplus of $108K and the insurance premium is due in the first month of the financial year then the surplus is a good thing. It allows the insurance to be paid without the administrative fund going into deficit.

Although the insurance premium is paid each year from the surplus by the end of the year the insurance premium will be due again. So although funds are available already for the insurance, insurance budget needs to be collected in the current year to be available at the start of the next financial year.

If they budget $90K for insurance and pay $90K then they’re incurring expenditure in line with the budget. That the funds are available already is simply a matter of timing and cash flow management.

So I guess that means I agree with strata manager / committee.

Hi Lisa

I have researched a similar issue through the Adjudicators’ Orders and have found a number of references to the collection of levies in one year for an expense in the following year as being in contravention of the Act, as is the collection of levies to deliberately create a significant surplus. I believe that the basis of this view is that if an owner sells early in the financial year, then they are unable to recover their contribution to the surplus and have seen no benefit.

Isn’t the correct way to handle the writer’s insurance matter, the issuing of an Interim Levy or changing the financial year dates?

Cheers

Trevor Roberts

Hi Trevor

Yes that is correct, however not so easy to put into practice, particularly with something so crucial as insurance and funding. The legislation acknowledges that at some stage every body corporate is going to contravene the legislation simply because it is so vast. Adjudicators don’t have much of a problem with that if its not going to affect owners, which I believe the insurance collection being discussed would not. Essentially the scheme is saving all year to pay one lump sum in the new year.

The alternative is not to collect the funds. The payment of the insurance premium might not be possible if funds are not available, or alternatively the scheme goes into deficit, using sinking funds to fund the deficit until more can be raised. That will detrimentally affect owners who might buy into the scheme early in the new year who’re now buying into a debt. To me it seems more like they’re collecting for something that’s due end of financial year, even though its paid in next year.

Changing the financial year end date would be the ideal way of doing it, and many schemes do have their insurance renewal three – four months after financial year end. Again however, not something that’s easy to do without affecting lot owners.

Hi Lisa

Thanks for that response. I do agree that as insurance premiums rise dramatically, as they have in recent years in Qld, the managing of the payment becomes more difficult. However the determinations I have read on the matter of deliberately budgeting for a surplus have been very critical of those bodies corporate. I believe it is more important to comply with the legislation as a first principle for the body corporate and then work out the best way of managing the insurance payment, especially as there are suitable alternatives that will comply with the legislation. Otherwise you get to a situation where the body corporate develops a habit of treating the legislation too casually.

Thanks again for the response.

Cheers

Trevor

Hi Lisa

What % of our levies go to the caretaker and how is this calculated?

How do you calcuate the amount what the lot owners pay from the levies to the caretaker?

ie The apartment worth 1 million dollars was taken out the purchase price of the management rights does this reduce the amount the lot owners pay to the caretaker?

Hi Janice

You’d need to refer to your body corporate administrative fund budget. Find out how much the costs are to the Caretaker and divide by total admin fund budget for the year. It will differ each year. Caretaker remuneration will be set out in the Caretaking Agreement. There is likely a clause in that Agreement that includes annual increases.

The value of the Management Rights has nothing to do with the contributions owners pay. The Seller / Buyer agree the value of the Management Rights with or without the apartment. That value won’t impact on the levies.

The two factors of the Caretaking Agreement that will influence matters will be term and remuneration.The length of the term of the Caretaking and Letting Agreement will most definitely impact on the value of the Management Rights. That won’t affect lot owners, except of course over the long term. Its the remuneration paid that is both attractive to buyers and drives the levy costs for owners.

By far the most income the Caretaker will get is as letting agent.The letting agent fee paid by owners to the Caretaker as their agent is not related to the body corporate and is negotiated between parties.

Hi Lisa,

Is there a maximum % increase in Body Corporate fees a committee can increase each year.

And is that the total Admin and Sinking.

or Individual.

When we had a sinking fund forecast done it increased levies by 40% down to 19% over 5 years before

leveling out at 4.9% over the remaining 7 years

Hi John

No, there is no maximum increase. In fact the body corporate is required to collect how much is needed. So, in every case levies are dictated by the needs of the scheme.

There is no requirement to follow the recommendations of the Sinking Fund Forecast either.

Hi am being inundated with everything unfair dicission possible, purshased industrial shed ,may 2020 informed by agent no body corperate committee ,is self governing , so i painted place ,then chairperson appeared ,threatened action ,move boat off common area , other tennants had stuff on common property but slowly removed everthing ,scorched earth policy ,then lodged complaints with Tribunal, i didnt attend due to medical reasons , Tribunal delivered orders ,no anomals no painting no music no parking ,etc now cannot go back , body corperate chairperson has been making offers to purchase property , sending correspondence via his professional capacity ie legal letterhead ,never under title of chairperson ,is this action a breach of power ? And a miss us of power as feel intimidation to purchase property was only intention.

Have been showered with invoices ,painting invoices all done whilst interstate getting treatment,

Feel will have to sell as no animals is no dogs no me .

Please advise on some points raised obviiously may facts missing ie judus priest played at 1,30 in the morning , but still fell harrased

Thank you

HI Anthony

It sounds like you got some inaccurate information from your sales agent. It also sounds like you may have been breaching by-laws, hence the ongoing problems. That an Adjudicators Order has been granted seems to imply that is the case.

It will be in your own best interests to comply with the Order.

Re: the invoices. It will depend on what these invoices are for. If you’ve painted the building without permission, and an Adjudicator has ordered the area be repainted, you should have been given an opportunity to rectify. If you have not, and the body corporate then rectified on your behalf, then the invoice is valid. Perhaps it would be wise to seek legal advice on how best to address these issues.

Since the property is not what you were expecting it may be in your best interests to sell. It sounds like the Chairperson is offering to buy the property under his own banner. Please note this has nothing to do with the body corporate. That would be a personal matter between you and the Chairperson. If you have concerns, which it seems you do, if you do choose to sell perhaps you should take the property to market to ensure you’re getting the best deal.

I bought into a property in mid Sept and the figures presented to me showed a healthy sinking fund. There are 44 units. The end of FY is Oct 31st.

New figures were presented at the AGM and no alarm bells. Now we are being told that there is a $60k deficit and a special levy is required. When asking questions about how this has happened there has been no sufficient answer. The BC manager prepares the financial reports and the levy calculation. It is clear that this situation has not only been since this FY but the miscalculation has just caught up. Apart from $15k there has been no unusual or sudden expenses. 2 Units have recently been advertised for sale, once again with the healthy sinking fund tag. I phoned the RE Agent he tells me that they are sold and contracts with the lawyers. He will not be disclosing the special levy he tells me. Where does the RE agent, BC Manager and the BC committee stand in this.

Hi Janice

Just because a sinking fund is healthy does not preclude a deficit in administrative funds. The sinking fund is capital savings. Administrative fund is year to year costs. Deficits most often arise in administrative funds and since there is no transferring between the two funds the deficit needs to be repaid. Essentially what has happened is more has been spent than collected “borrowing” against sinking funds. The special levy will replace those funds.

If a special levy is not disclosed in a contract then the purchaser has the option to cancel the contract is they choose to. It will be up to them and they of course need to find out about it.

I own a unit in a block of 4 units. If my BC wants to take out a loan to do plumbing repairs, but I can afford my portion, am I obligated to be part of loan?

Or can I simply pay my portion and let the other 3 units take on the BC loan?

Hi Luly

You will be bound by whatever decision the collective owners make. So … if they vote to take out the loan you will be required to make loan repayments along with other owners.

I suggest you vote NO to the motion to enter the loan when it comes up.